Tokens.net, a new cryptocurrency exchange for ERC20 tokens and other crypto-asset trading has so far has raised over $12 million dollars with 10 days left on its token sale campaign. Mr. Damian Merlak is leading the development and brings with him experience from EU bitcoin exchange Bitstamp, which adds enormous value to the project. Mr. Merlak says “I have brought together a great team to accomplish this job as they have demonstrated years of experience in cryptocurrency exchange operations, software development, information security, risk, and finance.”

To differentiate itself off the bat, Tokens is introducing a crypto-asset which is being generated during its ICO called Dynamic Trading Rights (DTR). DTR looks to revolutionize the current crypto exchange environment as the exchange will not be collecting fees for running operations. Instead, Tokens.net will use fees to purchase DTR tokens which will, later on, be provably burned by a smart contract.

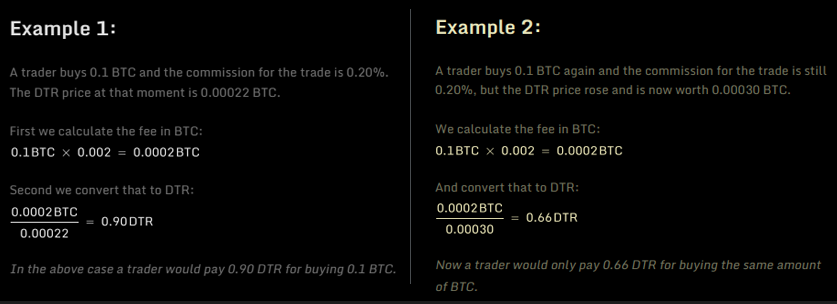

The uniqueness of DTR will support the company’s efforts in providing a reduction of effective transaction fees for the long-run. The exchange is hoping to attract market makers, whales and other traders that seek low and cost-effective trading vehicles. The DTR price will also correlate with exchange volume, which means DTR will, therefore, act as a hedge in times of crypto-market uncertainties and price correlations.

Merlak, the leading architect and founder of the Tokens trading platform added:

“As current crypto trading platform standards are very low concerning security, customer support, personal data protection and reliability I am confident my team and I will provide the crypto community with a new standard, a trading environment providing trust, transparency, safety, and reliability driven by Tokens solutions.”

Example DTR Benefit – from the Tokens whitepaper

Trading Volume Transparency

Since every trade on the Tokens platform will burn a certain amount of DTR, the daily volume on the platform will have to match the number of tokens burned every single day. This will make Tokens 100% transparent. There will be no way of cheating and artificially be boosting the volume on any trading available.

DTR Liquidity

Since trading fees are payable in DTR, a user may reduce their stock by two options: either by inserting a sell order and waiting for an automatic conversion to set against it or by trading, as DTR are subtracted as payable fees. These two DTR features make the Tokens platform unique in providing constant liquidity and an automatic offset.

ICO Distribution

The majority of DTR tokens, 40% will be proportionally distributed among ICO backers (BTC, ETH, XRP accepted). 30% will be reserved for team members and future employees. The team will have 4 years vesting and 1-year cliff. 30% will rest with the company. Should the ICO money run out, the platform must not discontinue. To solve this problem, the company will liquidate small amounts of tokens to fund operations. Distribution will occur 7 days after token sale ends.

After the ICO ends, the team will get to work towards its roadmap plans to launch a private beta of the platform in April 2018, and mobile app beta by June 2018. Come July 2018, the team is planning to prepare for public launch, with the following month of August to be the mobile app public launch date. Everyone is looking forward to next spring and summer to see how the new ER20 exchange platform, which will utilize the DTR token will function. The team is planning for more announcements regarding the development a few weeks before the first private beta launch.