Injective Protocol, a fully decentralized derivatives exchange protocol, has raised $2.6 million dollars in a seed funding round led by Pantera Capital with participation from other institutional investors including QCP’s investment arm QCP Soteria, Axia8 Ventures, and OK’s strategic investment partner K42.

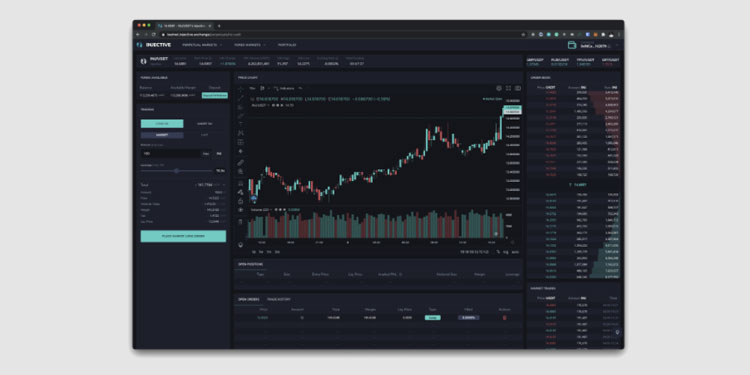

Injective Protocol aims to solve critical scalability and user experience bottlenecks that trouble decentralized exchanges (DEXs). Beyond providing working capital, the new strategic investors will also provide liquidity solutions for the decentralized exchange as well as support Injective Protocol’s business development and market brand recognition internationally.

Paul Veradittakit, Partner at Pantera Capital, commented on Injective Protocol, “Injective Protocol scalably brings advanced derivatives capabilities to DeFi while being uncompromisingly decentralized. We see Injective as a strong contender to expand DeFi beyond just Ethereum power users and to serve as an integral layer ushering the new dawn of decentralized derivatives.”

Selected as one of the eight projects to join the Binance Labs Incubation Program in 2018, Injective Protocol has sought to improve the poor liquidity, high latency, and lack of compelling product offerings that characterized decentralized exchanges. Today, Injective Protocol’s Layer-2 derivatives exchange protocol provides a fully decentralized, trustless, and front-running resistant exchange protocol that improves the experience of decentralized derivatives trading.

The fresh round of funding arrives in time as the team gears up for mainnet launch and token issuance in the latter half of this year.

The disclosed list of investors for the round includes Pantera Capital, QCP Soteria, K42, Axia8 Ventures, Boxone Ventures, Bitlink Capital, BitScale, Krypital Group, The Cabin Capital, and Innovating Capital.