In the November 2019 edition of the SFOX monthly volatility report, the SFOX research team has collected price, volume, and volatility data from eight major exchanges and liquidity providers to analyze the global performance of 6 leading cryptoassets — BTC, ETH, BCH, LTC, BSV, and ETC. The following is a report and analysis of their volatility, price correlations, and further development in the past six weeks.

SFOX’s Current Crypto Market Outlook: Neutral

Based on calculations and analyses, the SFOX Multi-Factor Market Index, which was set at mildly bullish a month ago, has been moved to neutral as of December 9th.

SFOX determines the monthly value of this index by using proprietary, quantifiable indicators to analyze three market factors: price momentum, market sentiment, volatility, and continued advancement of the sector. It is calculated using a proprietary formula that combines quantified data on search traffic, blockchain transactions, and moving averages. The index ranges from highly bearish to highly bullish.

The prices of bitcoin and other leading cryptoassets have decreased substantially over the last few weeks, but they have subsequently seemed to have stabilized, with volatility decreasing significantly from the end of November into the first weeks of December.

However, as detailed in the most recent market intelligence report, crypto prices have experienced upward movements that correspond with recent holidays — potentially because market participants may expect and try to front-run such holiday fluctuations. Meanwhile, overall trading volumes appear to be low while new bitcoin options products are rolling out, leaving it unclear how long it will take institutions and traders to actually begin taking advantage of these new products. In light of these factors, the current setting of the Multi-Factor Market Index at ‘neutral’ may be at least partly due to uncertainty regarding how bitcoin and other cryptoassets may react to upcoming investment product launches, together with holidays such as Christmas and New Year’s Eve.

What’s Happened in the Last Month and What to Watch Next

Markets

Crypto exchanges show decreased but punctuated BTC trading volume

Bitcoin trading volumes have been relatively low since November 1st, averaging 21,459 BTC traded per day between then and December 9th. This contrasts with an average daily trade volume of 26,544 BTC throughout all of 2019 thus far.

The most significant decrease in BTC price over the last month — a drop of 6.44% on November 22nd — corresponded with a spike in volume of BTC traded (a total number of 74202 BTC traded that day). While it’s not clear what caused this spike, it’s worth noting that, according to CoinMarketCap, USDT trading volume also spiked that day at $34,827,768,035, which could theoretically have been associated with both the volume spike and price drop.

New Crypto Fund Research report says that crypto hedge funds are closing (December 3rd)

According to Crypto Fund Research’s new report, nearly 70 crypto hedge funds have closed this year and the number of new funds launched this year is less than half the number launched in 2018. This suggests that funds and institutions may still have some trepidation when it comes to investing in cryptocurrencies, despite the products that are being launched, in large part, to cater to their needs (e.g., regulated BTC futures, new crypto custody solutions).

Products

Bitcoin options products have begun going live, starting with Bakkt (December 9th)

Bakkt launched its bitcoin options product on December 9th, with OKEx announcing the launch of their own bitcoin options product coming December 27th. These both come ahead of the CME’s bitcoin options product, which was revealed to have a launch date of January 13th.

The addition of bitcoin options to the crypto market provides traders with more flexibility in their trading, allowing them to take on non-linear exposure to bitcoin and develop new strategies for hedging and speculation. While Bakkt reported record daily volume of $42.5M on November 28th leading up to options launch, it remains to be seen whether bitcoin options will draw more institutional investment into crypto, which seems to be the expectation of some.

The U.S. Patent Office issued Nike’s patent for blockchain-compatible sneakers, “CryptoKicks” (December 10th)

This marks another large enterprise company acknowledging the opportunities presented by blockchain technologies. According to the patent, Nike’s CryptoKicks will be constituted by a physical pair of sneakers linked to a non-fungible digital asset, allowing proof and transfer of ownership. Owners will also apparently be able to “breed” their own CryptoKicks with other CryptoKicks, in the spirit of CrypoKitties, to create new “shoe offspring” tied to a brand-new pair of physical shoes.

Regulatory

Germany’s parliament approved regulations allowing banks to custody cryptoassets as of January 1st, 2020 (November 29th)

Germany’s parliament, the Bundestag, approved a bill implementing the fourth EU Money Laundering Directive, bringing further financial infrastructure for crypto.

This kind of regulatory clarity is a prerequisite for many larger funds and institutional investors being able to invest in crypto and, as such, is a good thing for the overall health, growth, and maturation of the industry. Time will tell whether the enactment of this law on January 1st is an omen of further regulatory clarity to come throughout the year.

Technical Developments

South Korean UPbit exchange hack lost nearly $50M worth of ETH (November 27th)

The theft of 342,000 ETH from UPbit marked the eighth exchange hack of the year, with The Block reporting that “the total amount stolen from cryptocurrency exchanges to date now stands at around $1.44 billion.” The price of ETH didn’t appear to react on the day, increasing just 1.5% from $146.59 to $148.77. Hacks continue to be an issue for exchanges, with John Sedunov, assistant professor of finance at Villanova University, positing that the rapid increase in crypto popularity since 2017 “may have caught some exchanges off-guard, and they may not have had the capital on hand, time, or even the technical ability to ramp up security features fast enough to ward off potential attackers.” Nevertheless, many exchanges are working constantly to develop new security technologies and protocols to keep ahead of hackers. Moreover, increasing exchange and sector regulation, such as those discussed above, could potentially help to improve the state of hacks in the industry.

The Details: Monthly Crypto Price, Volatility, and Correlation Data

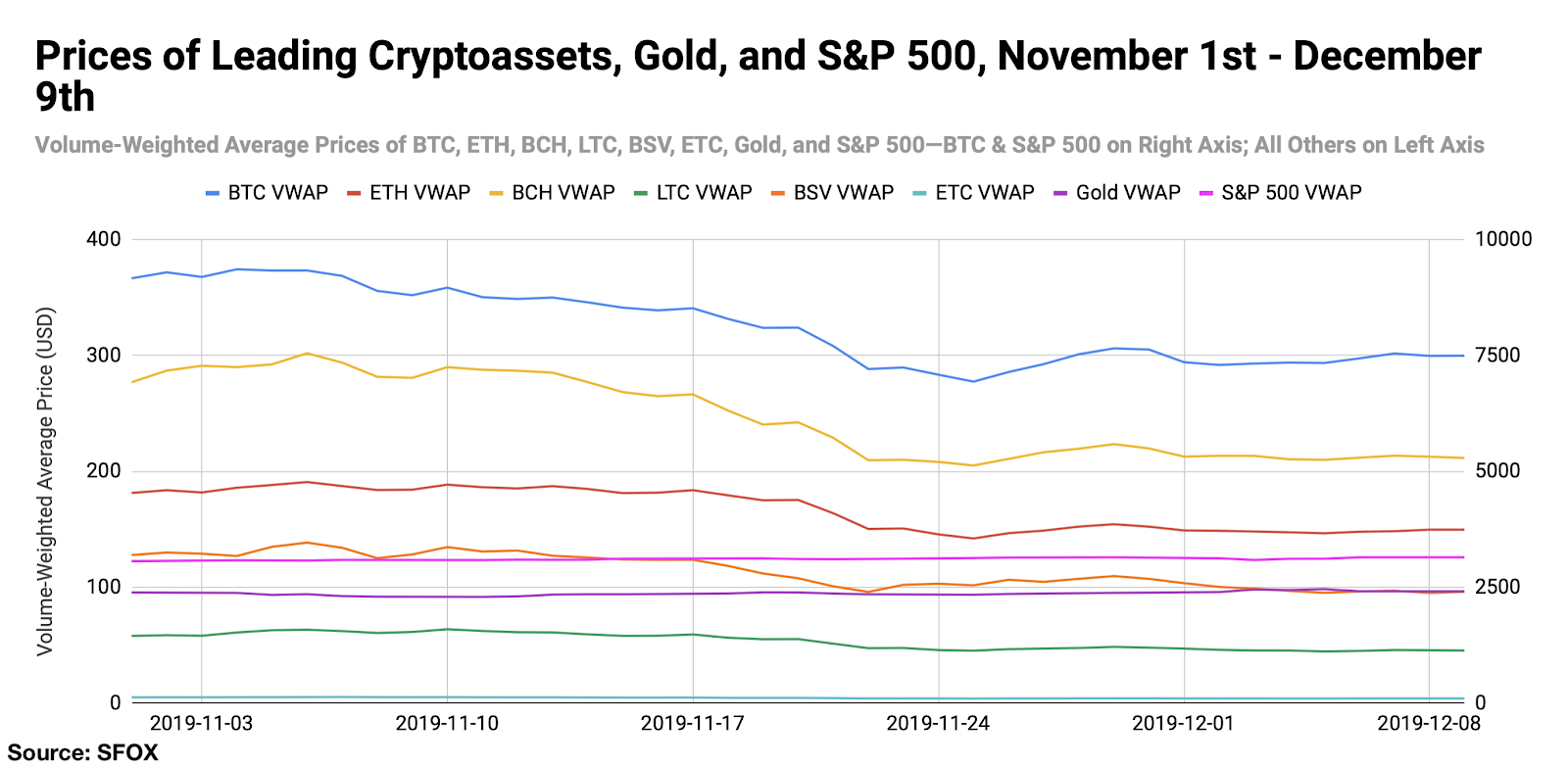

Price Performance: Decline, with a Thanksgiving Bounce

The price to buy bitcoin has ranged over $2424.58 — roughly 33% of its current price at the time of writing — in the past six weeks, peaking at a price of $9360.31 on November 4th and bottoming out at a price of $6935.73 on November 25th.

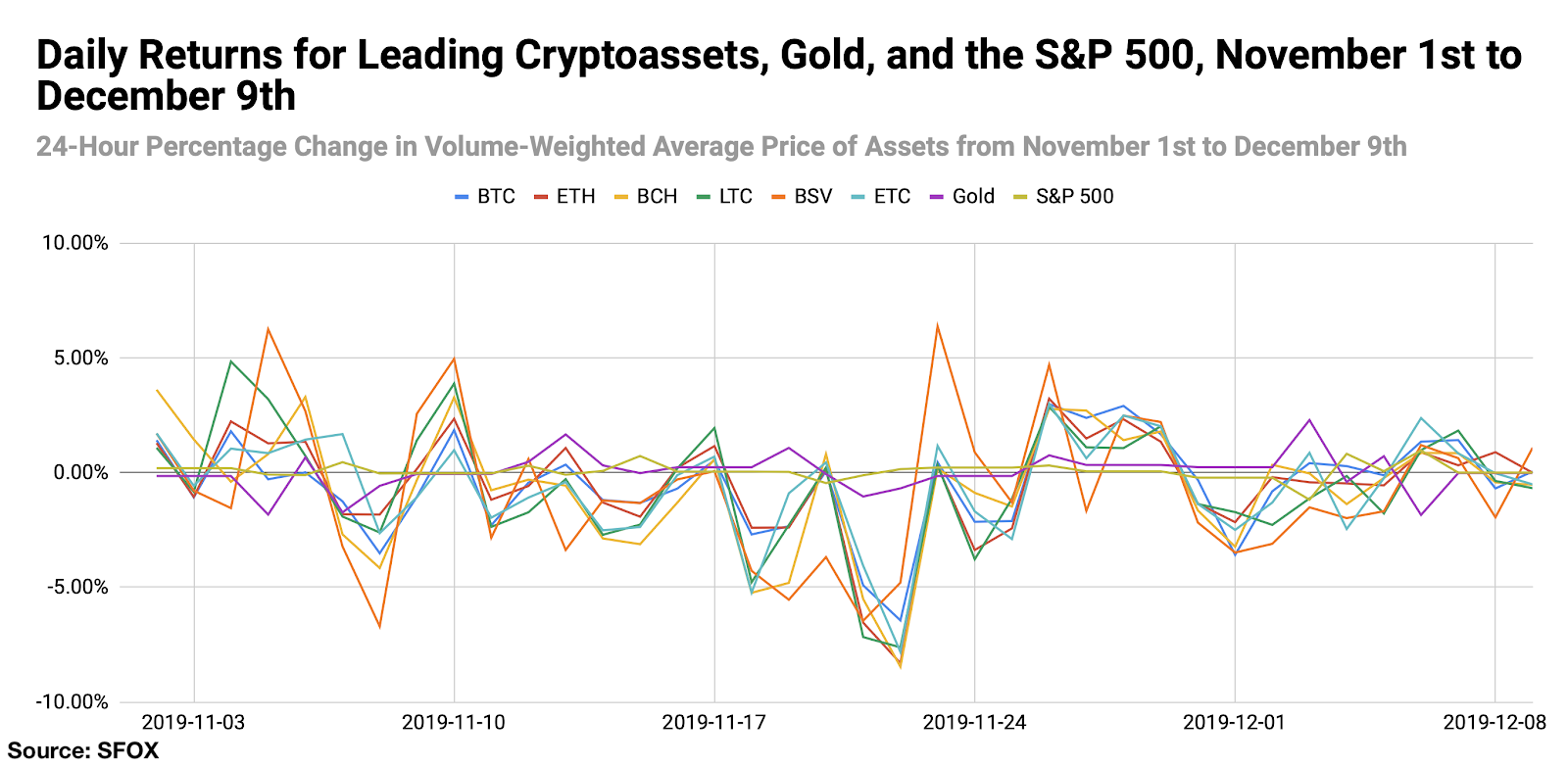

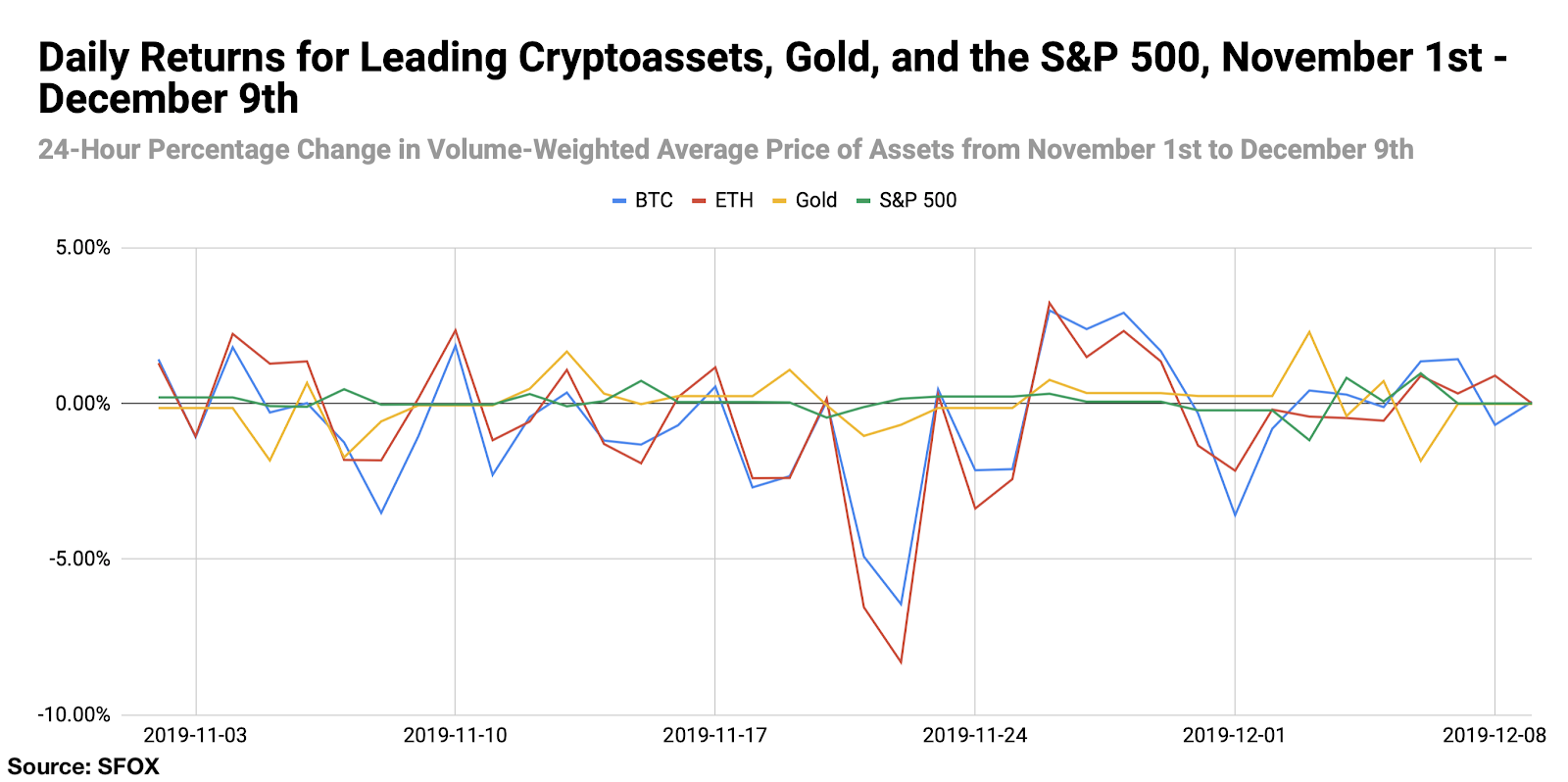

By looking at daily returns for leading cryptoassets, gold, and the S&P 500, it can be seen that the most pronounced single-day price change in crypto was November 22nd, which saw a 6.44% decrease in the price of BTC and an 8.30% decrease in the price of ETH.

For greater graphical clarity, see this additional chart tracking only the daily returns of BTC, ETH, gold, and the S&P 500:

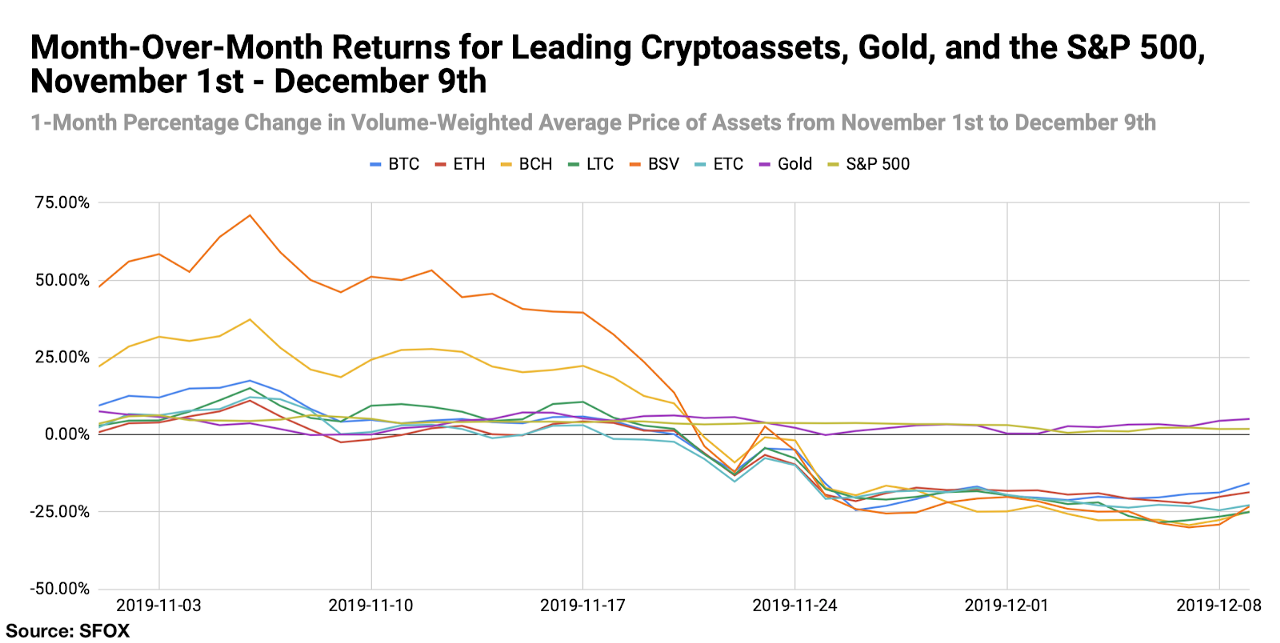

All leading cryptoassets showed month-over-month losses as of December 9th. Among these cryptoassets, BTC lost the least (-15.73%) and LTC lost the most (-25.06%). Gold and the S&P 500, meanwhile, posted month-over-month gains of 5.06% and 1.86%, respectively.

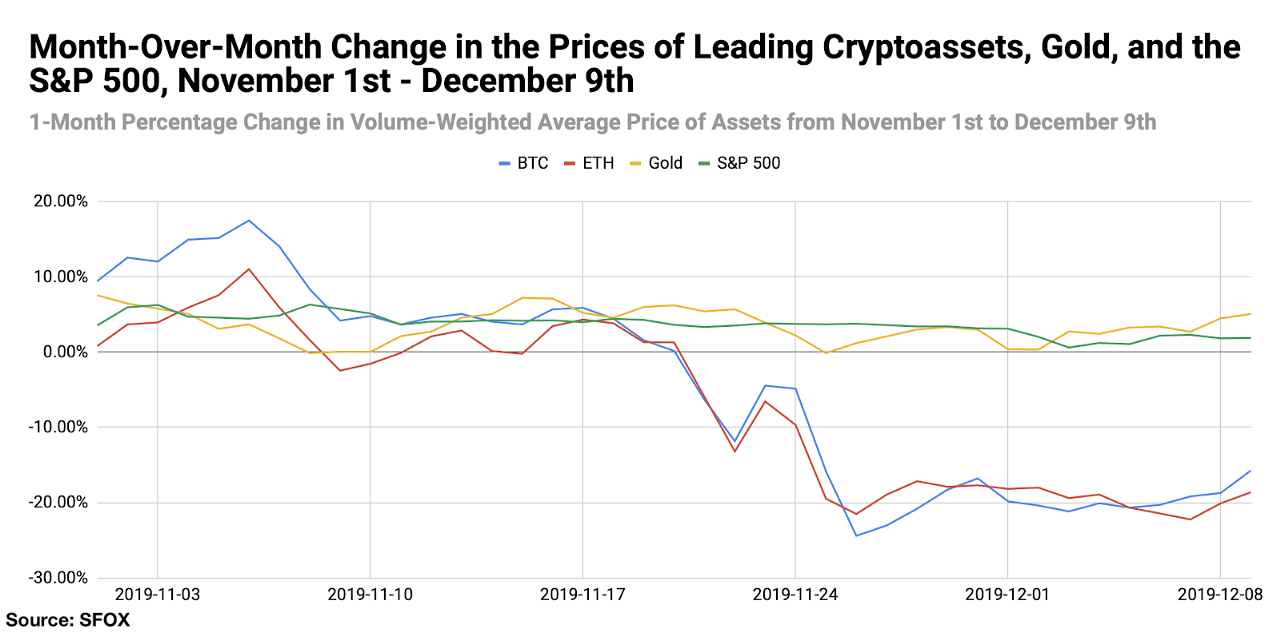

For greater graphical clarity, see this additional chart tracking only the month-over-month changes in the prices of BTC, ETH, gold, and the S&P 500:

Volatility: Lower Levels Ahead of the Holidays

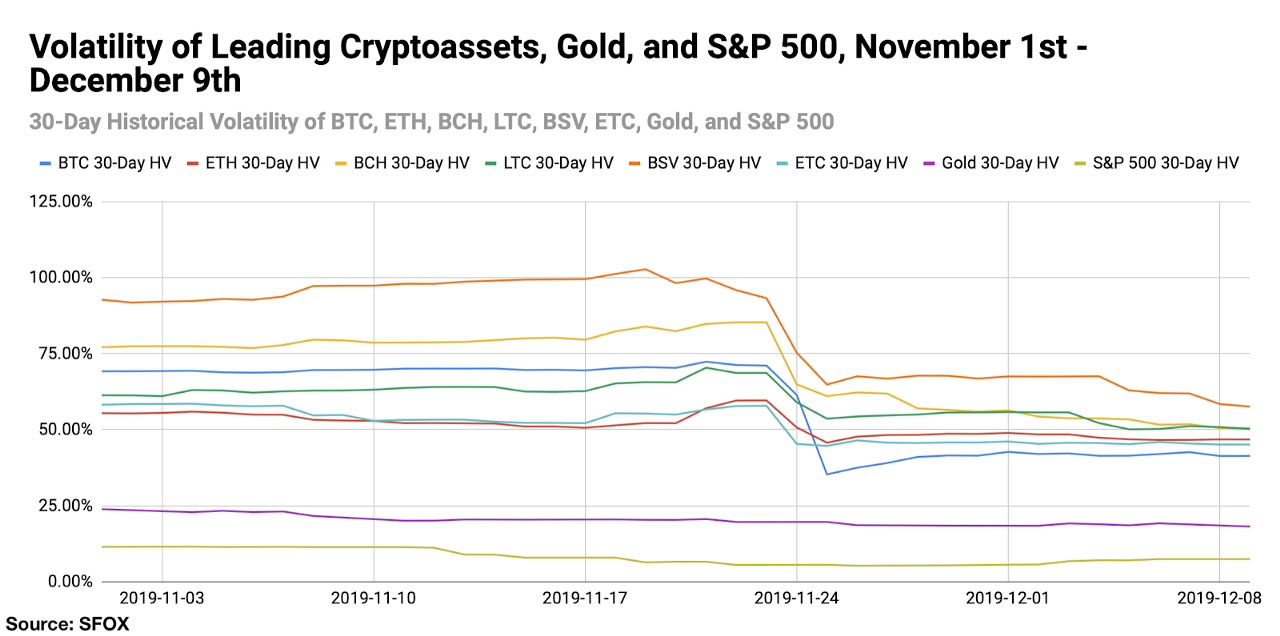

By looking at the 30-day historical volatilities of BTC, ETH, BCH, LTC, BSV, and ETC, it can be seen that the general trend of crypto volatility was fairly steady through November 23rd, at which point marketwide volatility levels decreased.

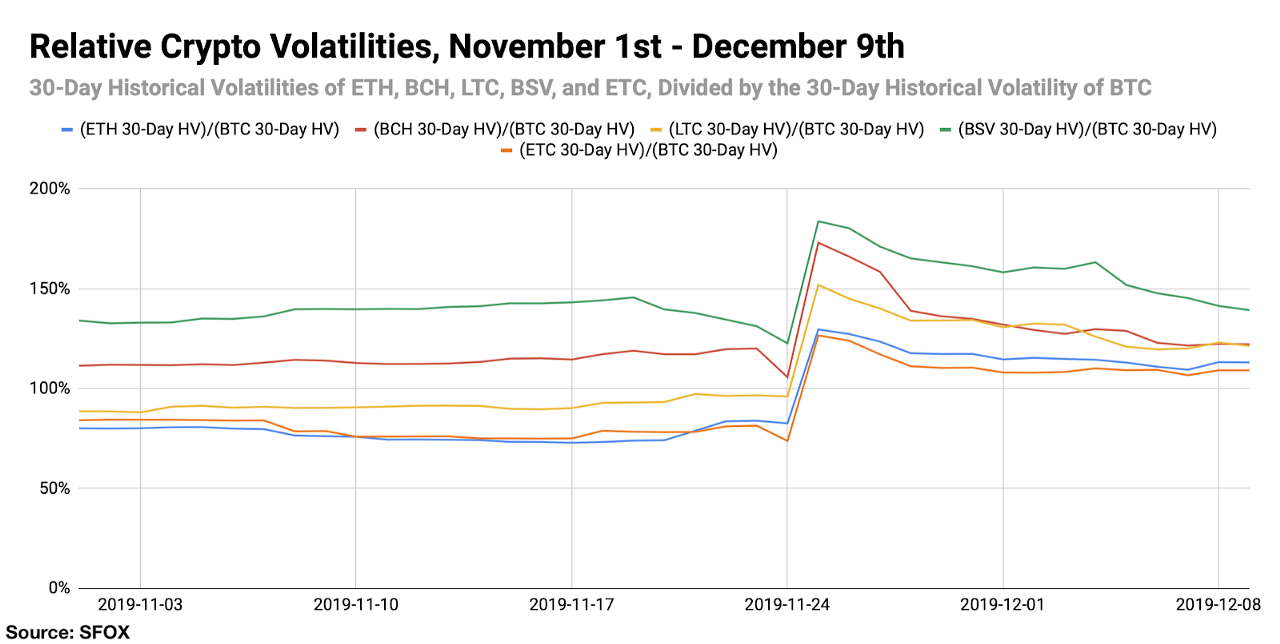

By looking at the 30-day historical volatilities of ETH, BCH, LTC, BSV, and ETC as a percentage of BTC’s 30-day historical volatility, it can be seen more clearly most altcoin volatility was following BTC’s volatility, with altcoins becoming relatively more volatile than BTC following the market movement from November 23rd through November 25th.

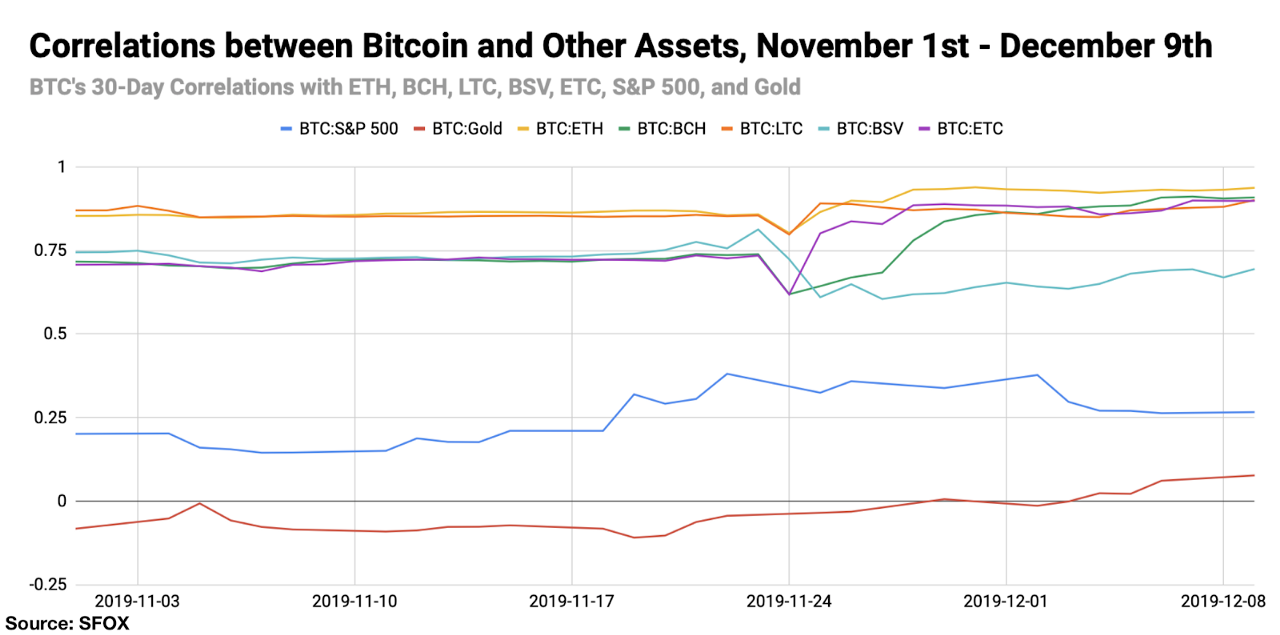

Price Correlations: High Crypto Correlations

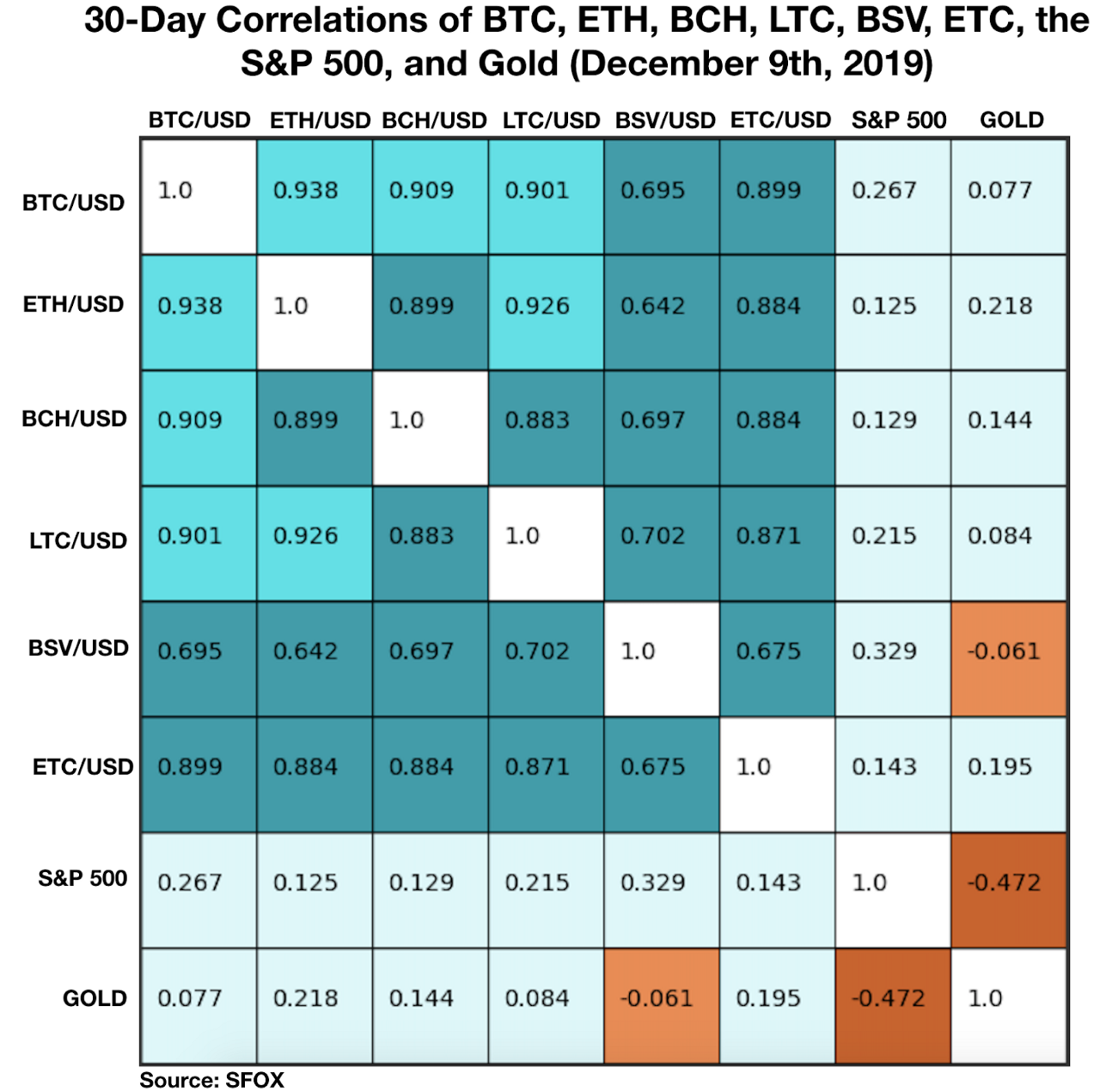

The most recent crypto correlations data show that BTC is highly correlated with ETH, BCH, LTC, and ETC — more so than it has been in recent times. It is notably less correlated with BSV (0.695 BTC:BSV correlation, compared with ~0.9 correlation between BTC and all other tracked cryptoassets). All cryptoassets remain largely uncorrelated with gold and the S&P 500.

See the full SFOX crypto correlations matrix below:

For a more complete look at BTC’s correlations with other assets throughout the past six weeks, see the following graph: