BTSE, a UAE crypto asset exchange, today announced the launch of a new futures trading platform, BTSE Futures, along with its 100x leveraged Bitcoin futures product. BTSE Futures is scheduled to begin trading in June 2019.

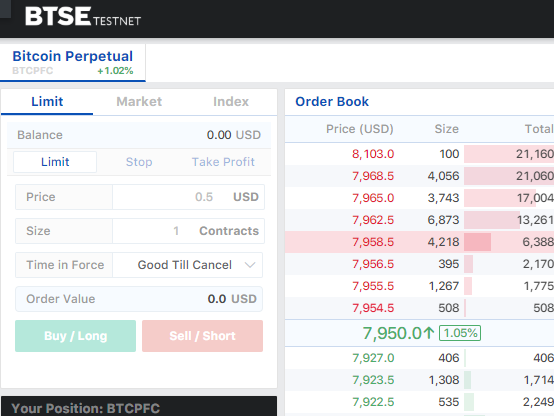

The new BTSE Futures platform supports fiat and cryptocurrency as margin collateral. Traders can post margin using a combination of both fiat and crypto when they trade USD-settled Bitcoin or Tether futures, without the need to make currency conversions.

BTSE supports 7 major fiat currencies, including USD, EUR, JPY, and GBP, and 4 major cryptocurrencies, including BTC, ETH, LTC, and USDT.

Linear US Dollar Settled Futures

Although commonplace in the cryptocurrency space, inverse futures contracts, non-linear in nature, result in a complex mechanism of deriving profit and loss. Conversely, traditional futures contracts embrace a linear design. Every price movement of a contract translates directly into profit-and-loss proportionally.

BTSE Futures platform embraces a simple linear design, where profit and loss are settled in US Dollar. Users can convert profits into native currencies of choice with one click through the platform’s multi-currency spot wallet or purchase USDT using the all in one order book.

“BTSE Exchange aims to become a leader in providing a suite of liquidity products to cryptocurrency traders and investors. Our multi-collateral futures platform bridges a gap between traditional fiat-based traders and coin holders. Additionally, our multi-currency order book enables global users to trade in an aggregated order book with thick liquidity.”

For those interested, a testnet of the futures product is currently available.