The Crypto Finance Group outlook for 2019 is strong after year one of operations. With a client base of over 100 professional investors and financial intermediaries, representing thousands of investors worldwide, the Crypto Finance Group is on its way as a leading provider of products and services for digital assets.

Despite renewed volatility and an evolving regulatory framework worldwide, the 2019 crypto asset market outlook promises professional investor growth and advances in blockchain technology. This evolution supports Crypto Finance in building its first-mover advantages.

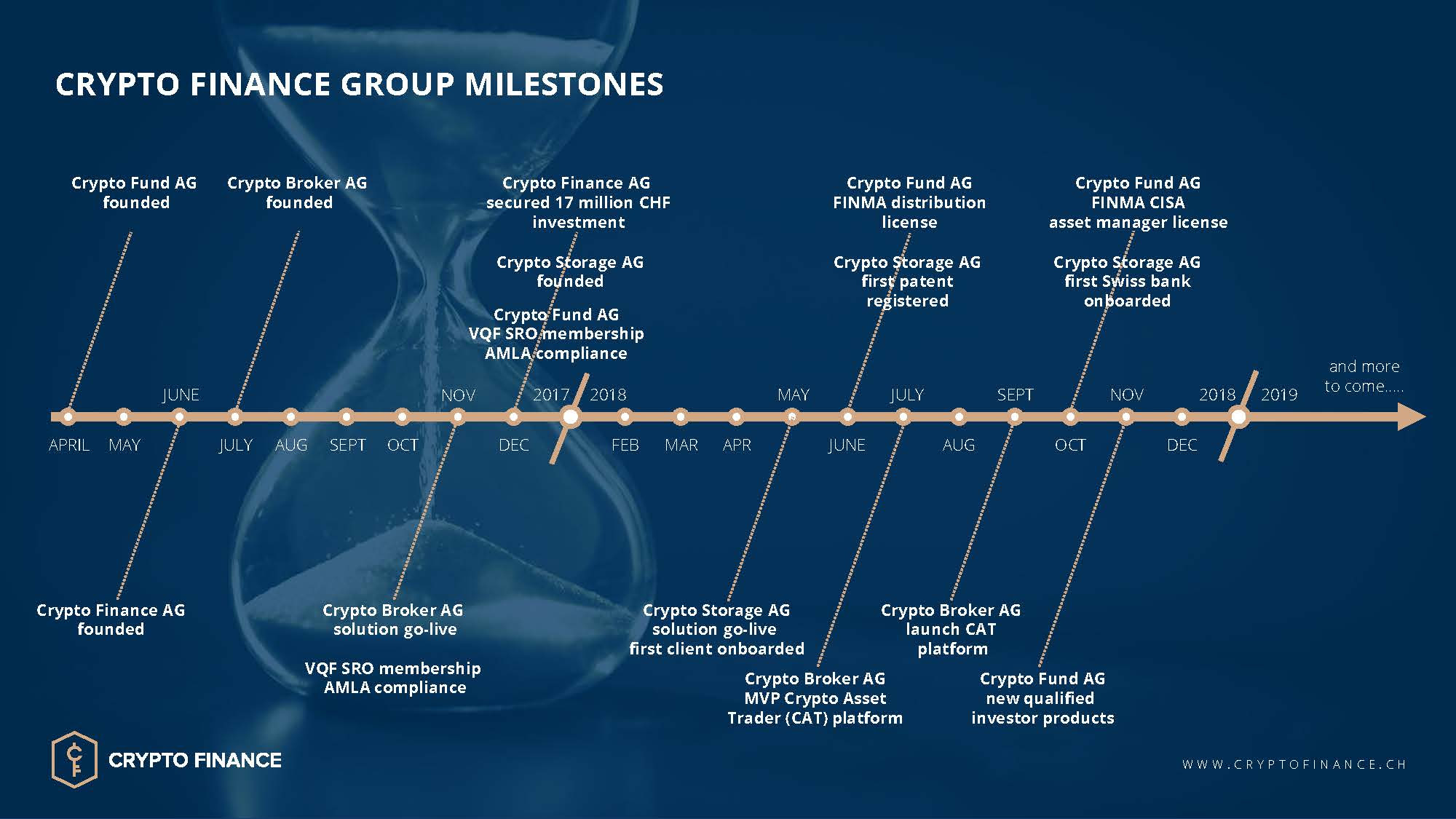

The Crypto Finance Group, active in asset management, brokerage, and secure storage solutions for digital assets, looks ahead to a promising 2019 after its first year of operations. Crypto asset volatility and value patterns in this period developed similarly to that of the early internet economy. With the experience built over the last year, the Crypto Finance Group and its three subsidiaries have achieved first-mover advantages of interest for professional investors.

“2018 was a year of milestones for the Crypto Finance Group. We are happy to have established such a solid foundation, which benefits our clients and also sets the stage for further growth in 2019.”

Among the 2018 milestones, Crypto Fund AG has been recognized in the industry: the company is the first – and currently only – regulated asset manager for crypto assets authorized by FINMA under the Swiss Collective Investment Schemes Act. The year 2018 was also a year of strong growth in crypto assets under management in the industry, despite the large price swings. With this signal of a major shift in the investment industry, Crypto Fund AG will launch market-leading crypto asset products for professional investors in early 2019.

The Crypto Broker AG’s trading services offer optimized order execution across the world’s top crypto exchanges. For 2019, Crypto Broker AG will grow its capability in market making, providing liquidity for an as-yet fragmented and immature crypto asset market. Already now, the company’s clients are benefitting from live streaming prices through an API (application programming interface) and native web interface. As crypto asset regulation evolves, Crypto Broker AG is further enhancing its regulatory status beyond AML and KYC requirements, having applied to become a licensed and supervised securities dealer.

Crypto Storage AG is live and operational with multiple infrastructure solutions for clients to create, store, and handle crypto asset keys in complex institutional and corporate environments. Clients are able to store over 60 different crypto assets, including those that emerged from the recent Bitcoin Cash hard fork. Just three months after onboarding its first clients, the company also passed a SOC-2 audit. For 2019, Crypto Storage AG is developing additional solutions for clients with highly specific multi-signature and automation needs, demonstrating its expertise and fluency in crypto asset storage technology.

“The Crypto Finance Group has a strong outlook for 2019: professional crypto asset investing is growing, even with price declines in 2018. The experienced trading and asset management team work with these market dynamics in their daily operations. “Bitcoin’s volatility and correlation with other crypto assets is a typical signal of market uncertainty. Our work in this field allows our clients to now participate on a professional basis and benefit from this developing asset class – across exchanges and crypto assets.”

What is next? An early 2019 highlight comes in January, with CEO Jan Brzezek speaking at the Crypto Finance Conference in St. Moritz, Switzerland, and meeting with leading investors in the sector.