Gemini, the New York licensed bitcoin and ether exchange owned by the Winklevoss twins have this week announced a new Fee Schedule. The best taker fee for liquidity-taking trades will now be 10 bps (0.10%), on each of Gemini’s three order matching engines: BTC/USD, ETH/USD, and ETH/BTC and the best maker fee for liquidity-making trades will be 0 bps (0.00%).

Gemini’s market participants can achieve these favorable fee rates based on their 30-day trading volume. This new fee schedule will go into effect at midnight UTC, November 15, 2017 (7:00 pm ET, November 14, 2017), and then be applied to all trades going forward from that time. The company also said it will be removing the previous requirement related to maintaining a specific buy/sell ratio.

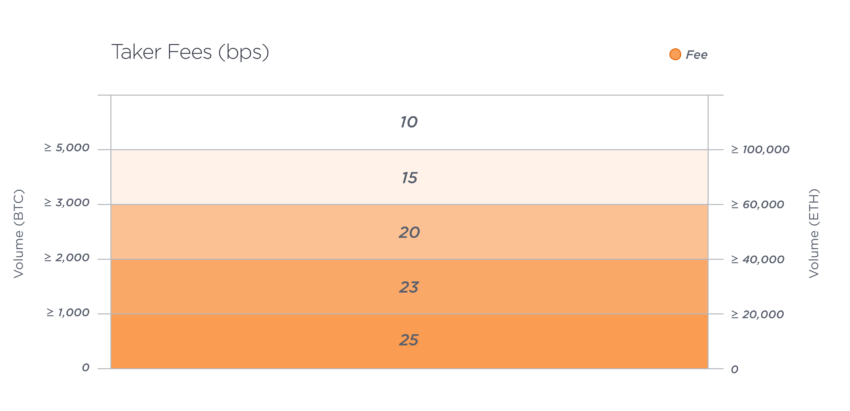

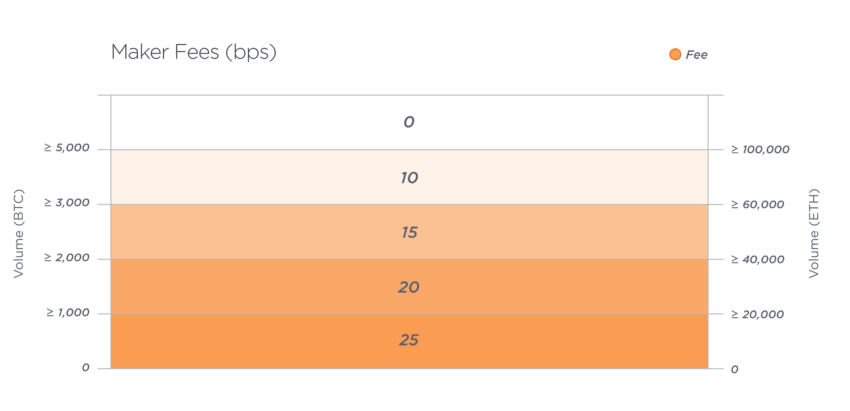

Below are tables and charts illustrating the updated Fee Schedule:

| 30-Day Volume (bitcoin) |

30-Day Volume (ether) |

Taker Fee | Maker Fee |

| 0 | 0 | .25% | .25% |

| ≥ 1000 | ≥ 20,000 | .23% | .20% |

| ≥ 2000 | ≥ 40,000 | .20% | .15% |

| ≥ 3000 | ≥ 60,000 | .15% | .10% |

| ≥ 5000 | ≥ 100,000 | .10% | 0% |

To note, all trades executed in Gemini’s daily BTC/USD and ETH/USD auctions will be subject to the same liquidity-making fee schedule and will be included in a client’s 30-day trading volume used to determine the appropriate fee rates.