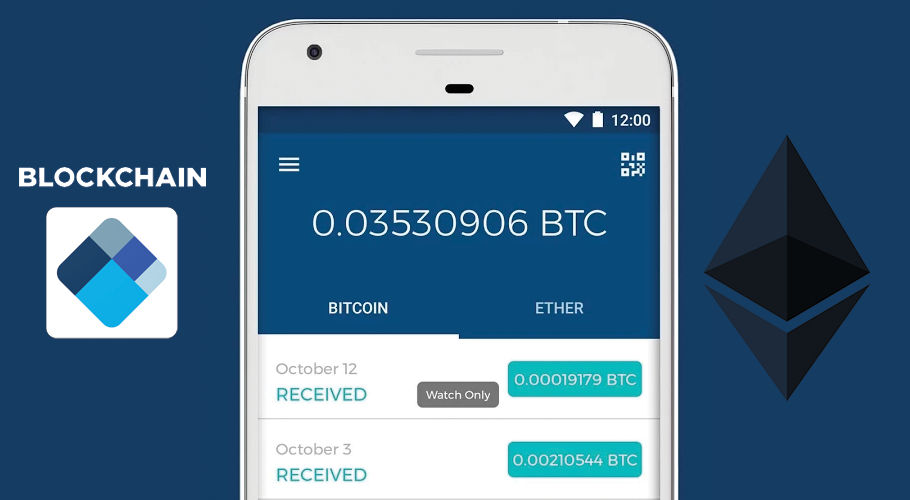

Digitrade Financial Corp (OTCQB: DIGAF) a digital asset exchange platform, blockchain development services and fintech advisory company today announced the execution of a development agreement with ANX International to integrate the Ethereum token (ETH) onto the Digatrade Exchange Platform. The functions included will be to enable withdraw and deposit functions and enable the trading pair ETH/BTC.

In response to a possible Digatrade token release, Digitrade is currently reviewing with its legal advisors the regulatory and compliance framework recently published by the Canadian Securities Administrators (CSA) who on August 24, 2017, published a notice which outlines how securities law requirements may apply to initial coin offerings (ICOs), initial token offerings (ITOs), cryptocurrency investment funds and the cryptocurrency exchanges trading these products.

Brad Moynes, CEO of Digatrade stated:

“In response to an influx of inquiries, if Digatrade were to offer an ICO or token release (subject to regulatory guidelines) to its community as part of a broader digital corporate finance model; the Etheruem (ETH) smart contract would be an efficient mechanism to govern and operate the process and as a result will be listed on the Digatrade Exchange”

The notice describes the factors CSA staff consider in assessing whether prospectus, registration and marketplace requirements apply. It also outlines how the CSA can help fintech businesses contemplating such offerings and summarizes key issues that businesses should be prepared to discuss with CSA staff.

Louis Morisset, CSA Chair and President and CEO of the Autorité des marchés financiers commented:

“The technology behind cryptocurrency offerings has the potential to generate new capital raising opportunities for businesses and we welcome this type of innovation. Given the growing activity in this novel area, we are publishing guidance to help fintech businesses understand what obligations may apply under securities laws.”

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third-party interference. These apps run on a custom built blockchain, an enormously powerful shared global infrastructure that can move value around and represent the ownership of property. This enables developers to create markets, store registries of debts or promises, move funds in accordance with instructions given long in the past (like a will or futures contract) and many other things that have not been invented yet, all without a middleman or counterparty risk. The project was bootstrapped via an ether pre-sale in August 2014 by fans all around the world. It is developed by the Ethereum Foundation, a Swiss non-profit, with contributions from great minds across the globe.