SegWit (Segregated Witness) is the process through which the block size limit is increased by removing signature data from Bitcoin transactions. To simplify, when unnecessary data is removed from a Bitcoin transaction, it frees up space for more transactions to take place on the blockchain.

Activating SegWit

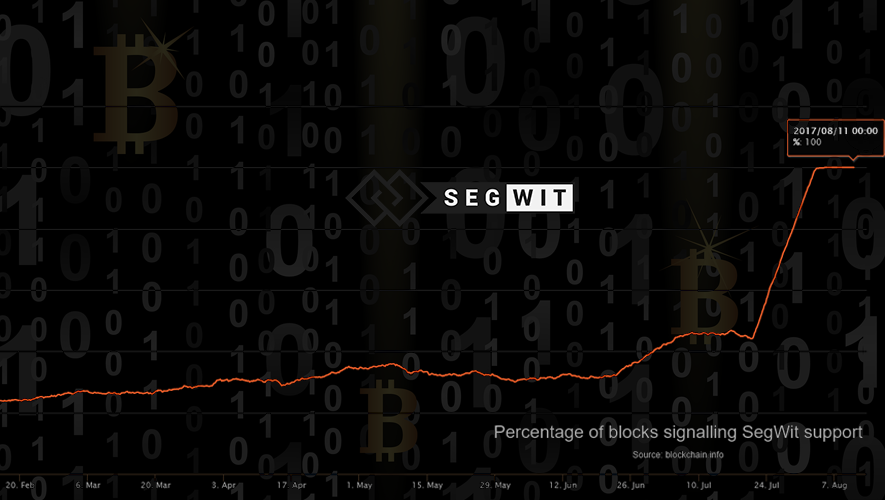

Despite some popular belief and interpretation, this week the scaling proposal named SegWit also known as BIP 141 was “locked-in” officially on the Bitcoin network. The multi-year process of getting Bitcoin Core’s stipulated 95% miner approval has finally come to an end, which began the activation SegWit. The activation is a process that will take roughly two weeks to happen.

Why SegWit?

SegWit proposes to save the Bitcoin blockchain some space for each transaction that takes place by removing the signature data. Any transaction through the Bitcoin chain has inputs and outputs that are tracked through nodes, this makes the transaction incorruptible. So essentially, the transaction requires both its inputs and outputs and when both have been verified the transaction is viewable to the public domain.

The signature that is part of the transaction ensures that the sender of coins has the necessary funds to do so, so the “segregated” part of SegWit proposes to literally segregate the signature data from the Bitcoin transaction.

This idea was proposed by Bitcoin Core developer and the co-founder of Blockstream Dr. Pieter Wuille as a solution to the capacity of each Bitcoin chain which has a data limit of 1MB. It takes 10 minutes to add a new chain for new transactions to take place, so SegWit is a concerted effort to make the whole process more data-efficient and sustainable because for each transaction the signature data accounts for 65% of the transaction data.

What Does the Future of Bitcoin Have in Store?

This new strategy to optimize the transactions per chain size means that more bitcoins can be traded with the current infrastructure. Either way, this new segregation of signature data from transactions means we have lived the last days of integrated transaction and signature data.

Many in the Bitcoin community believe that this huge improvement will allow them to expand to new heights in the cryptocurrency world. Bitcoin wants to grow but has been plagued with the slowness of creating new chains to support the cryptocurrency. An ever ongoing process, only time will tell how this data saving strategy will affect the cryptocurrency and the market as a whole.