CoinTracking, a portfolio management platform for the tracking and tax reporting of cryptocurrencies today announced that in order to enter different transaction types more accurately and get more detailed classifications, it has decided to orientate towards the common law and tax standards, by increasing the number of transaction types.

With these additions it is possible to calculate the Tax Report much more efficiently, adding entries is much easier and it improves the structuring of a portfolio on CoinTracking.

Additionally, to the three current types of transactions (Trade, Deposit, and Withdrawal) it is now possible to enter more types into the system. These new transaction types are considered in all reports and especially have an influence on the Tax Report.

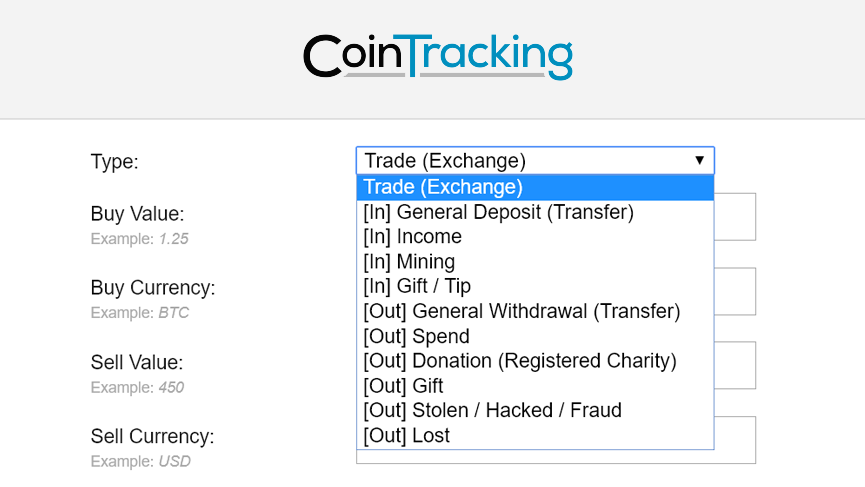

From now on, the following transaction types can be added to the system and have an impact on the calculations:

(EXCHANGE) Trade Purchases /Sales

Are listed in the Capital Gains Report.

(IN) Deposits (Transfer)

Are considered as transfers between wallets or exchanges and are not included in the calculation.

(IN) Mining

Are listed in the Income Report with the value at the time of transaction.

(IN) Gift/Tip

Are listed in the Income Report with the value at the time of transaction.

(IN) Income

Are listed in the Income Report with the value at the time of transaction.

(OUT) Withdrawals (Transfer)

Are considered as transfers between wallets or exchanges and are not included in the calculation.

(OUT) Spend

Are listed in the Capital Gains Report.

(OUT) Gift

Are listed in the Gift and Donation Report.

(OUT) Donation (registered charity)

Are listed in the Gift and Donation Report.

(OUT) Stolen/Hacked/Fraud

Are listed in the Lost and Stolen Report.

(OUT) Lost

Are listed in the Lost and Stolen Report.

Crypto tax/portfolio app CoinTracking adds new transaction types