TradeBlock, the professional data provider for digital currencies announced the public launch of the ECX Index and a set of associated tools to track its performance.

The ECX Index is an institutional-grade reference rate for the USD-denominated price of Ethereum Classic and will be used as the reference rate for the recently announced Grayscale Ethereum (ETC) Investment Trust.

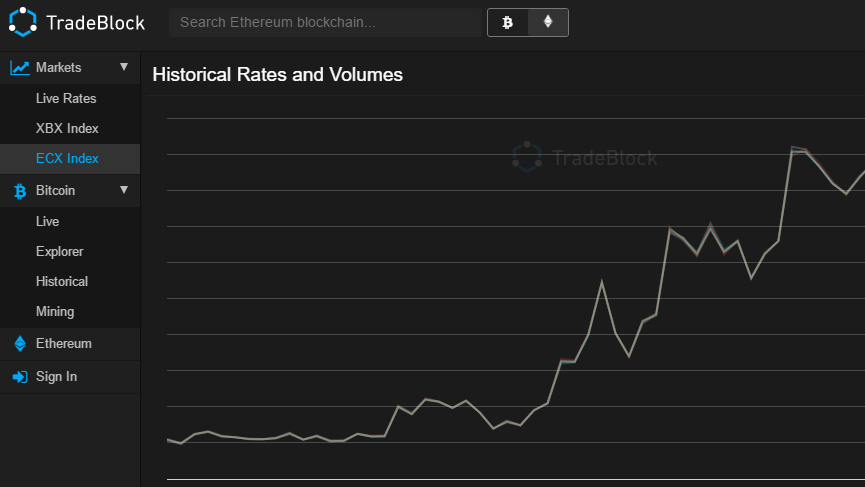

ECX Index

TradeBlock’s ECX Index is designed to track Ethereum Classic liquidity while adjusting for any deviations caused by anomalies and manipulation attempts at individual exchanges. The index value is a live rate that is calculated once per second based on the trading activity observed in the leading Ethereum Classic exchanges.

The data from all exchanges is collected in real-time and immediately cleansed and validated to ensure the reliability of all contributing trades. The data from each exchange is subsequently weighted against the cohort based on their short- and long-term trading volume. The most liquid exchanges receive a higher weighting in order to maximize the replicability of the index’s rate in the live spot markets. The index also weights every exchange based on the price variance across all data points and on the trading frequency at each venue.

Notably, the ECX index includes markets that are liquid in both the ETC/USD & ETC/XBT crosses, incorporating the XBX index rate to offer a consolidated ETC/USD reference rate.

The Ethereum (ETC) Investment Trust

Grayscale Investments announced the launch of the Ethereum (ETC) Investment Trust earlier this year which is designed to allow investors to gain exposure to the price movement of Ethereum Classic through the purchase of tiled securities.

The trust will use TradeBlock’s ECX Index as the reference rate to determine Net Asset Value.

The ETC trust will be the second product launched by the firm after its highly successful Bitcoin Investment Trust (BIT) which has allowed investors to gain bitcoin exposure since 2013.

A Reliable Reference for Ethereum Classic

The sustained economic growth of bitcoin has been a catalyst for increasing interest in the broader digital currency market. Once a market filled with a multitude of novel yet unproven offerings, digital currencies are now maturing into a market with established leaders that attracts the interest of casual and professional investors alike. Increasingly, these markets are being used by the public to store value, transfer value, profit on their volatility and to diversify portfolios. They also act as havens for the ongoing debates regarding the governance and technological aspects of the various technical protocols.

One of the most significant of these markets is Ethereum Classic, a protocol designed from inception offering more than a peer to peer electronic payment system by natively integrating smart contract functionality. Smart contracts provide a dynamic framework in which pre-defined conditions can be enforced and executed without requiring external intervention. The potential applications for the technology are vast and are poised to provide considerable value compared to traditional contracting practices by optimizing their mechanics and reducing their costs.

True to one of its founding principles, Ethereum Classic has maintained an immutable transaction ledger and it is now being traded in several markets around the world. As is the case with all digital currencies, the unique dynamics of the markets lead to less than straightforward price discovery. Spot markets with low liquidity are highly susceptible to price manipulation and to the incidental anomalies that have been prevalent in the venues that trade digital currencies.

Exchanges and their weighted share percent of the ECX Index can be seen below:

Constituent Prices (from April 12th, 2017)

| Exchange | Price | 24H Volume | 24H Avg. Weight |

|---|---|---|---|

| Bitfinex (ETC/USD) | 2.65 | 237,552 | 2.12% |

| Bitfinex (ETC/XBT) | 2.63 | 153,470 | 10.99% |

| Kraken (ETC/XBT) | 2.62 | 65,004 | 3.35% |

| Poloniex (ETC/XBT) | 2.62 | 623,147 | 83.55% |

The tools can now be accessed by going to the ECX Index section of the TradeBlock Markets page.