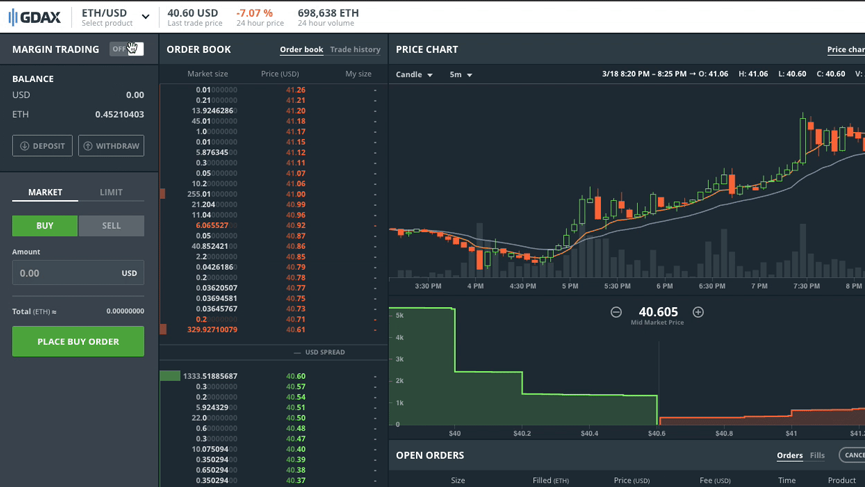

It was announced today from major U.S. digital currency exchange Coinbase, that its professional trading platform GDAX has introduced margin trading.

Eligible customers can now trade up to 3x leveraged orders on BTC, ETH, and LTC order books. To celebrate the launch, the exchange stated there will be no fees to access margin trading.

The goal of GDAX is to serve as a trusted digital asset exchange for institutions and professional traders. Today’s launch, along with the introduction of the GDAX Trading Rules, represents an important step towards that goal and the commitment to creating a more transparent and balanced market.

Adam White, Head of GDAX stated:

“Over the last few years, we have seen growing interest from institutions that desire advanced trading features. We are excited to launch a margin feature that meets the high demands of professional traders while addressing federal and state regulatory requirements.”

“We believe this feature will attract a new wave of institutional clients, ultimately reducing volatility and supporting the growth of the digital asset industry.”

Available Leverage

| Market | Leverage | Margin Funding Limit |

| BTC/USD | 3x | $10,000 |

| BTC/EUR | 2x | €3,000 |

| ETH/USD | 3x | $5,000 |

| ETH/BTC | 2x | 1 BTC |

| LTC/USD | 2x | $500 |

| LTC/BTC | 2x | 0.5 BTC |

Margin trading is not available on BTC/GBP at this time.