Two Prime, an investment firm specialized in digital asset and derivative strategy management, today announced the launch of its first actively managed digital assets fund, Two Prime Digital Assets Fund. Utilizing a derivative overlay strategy over core ownership of BTC and ETH, the Fund provides institutional investors, family offices, corporate treasuries, and high net worth individuals (HNWIs) with an intelligent investment vehicle to participate in the digital asset space — creating an uncorrelated hedge to a wider portfolio as the digital assets space continues to gain momentum.

Co-founded by open-source and emerging technology investor Dr. Marc Fleury and digital assets expert and Managing Director Alexander S. Blum, Two Prime created the Fund to offer investors a method for preserving their wealth while still benefiting from the rapid growth of digital assets. Firstly, digital assets regularly experience downturns of 50% or more and are subject to liquidity risks. Two Prime provides downside protection through options trading and lending to protect investors’ wealth.

Additionally, securely holding digital assets can be extremely high-risk, with hacks occurring frequently in the field. Counterparties are also still in their infancy and require extensive levels of due diligence. Two Prime works with leading industry participants, like Genesis, which launched the first U.S. OTC cryptocurrency trading desk in 2013, to mitigate these risks.

Two Prime’s Managing Director Alexander S. Blum said: “As an investor into our fund myself, I fully understand the barriers and hesitation when it comes to crypto exposure. Two Prime only works with insured institutional custodians and counterparties that have been properly vetted through deep due diligence. We want to create a risk-managed environment where institutional investors, family offices, corporate treasuries, and HNWIs may leverage an intelligent investment vehicle to participate in the digital asset space. By leveraging our collective experience in emerging financial technologies and statistically-driven investment strategies, we can offer investors downside protection while leaving open the chance to be highly correlated with upside volatility.”

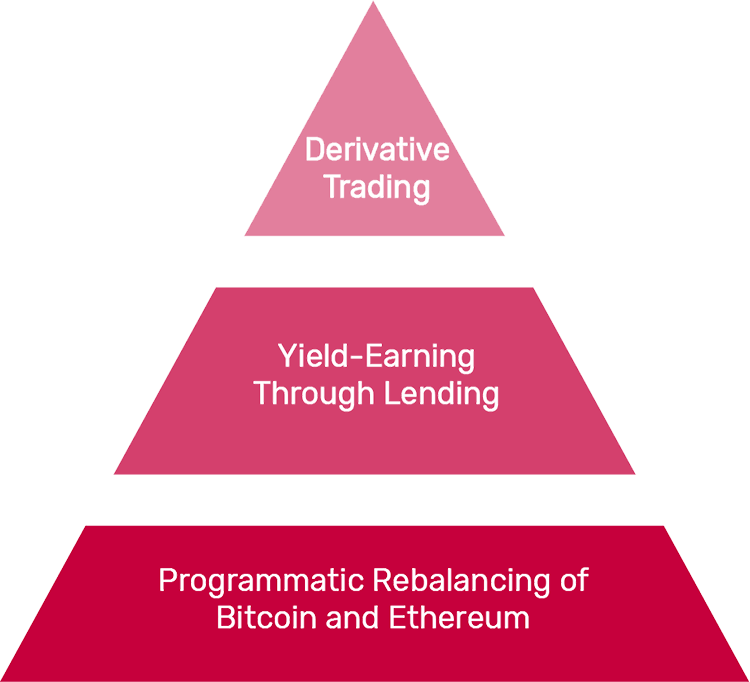

The Fund’s focus is purely on Bitcoin and Ethereum volatility management through three parts:

- Derivative trading overlay — With targets of .8 Beta upside and .5 Beta downside, the derivative trading overlay protects returns for investors

- Yield-earning lending — With the widespread adoption of digital assets, corporate treasuries and institutional investors will increase their store of reserves, diminishing the available supply to the public. Lending can be a great way to generate a steady yield for investors.

- Programmatic rebalancing of Bitcoin and Ethereum — Statistically-driven rebalancing of Bitcoin and Ethereum holdings for optimized returns.

“The speculative nature of digital assets is a high-level concern, especially for institutional investors, HNWIs, and family offices,” said Nathan Cox, Chief Investment Officer at Two Prime. “These investors have been keeping an eye on Bitcoin and Ethereum, but have been unsure when they should get involved and how. Many still see it as a highly speculative asset class. We’ve seen big institutions not only get involved in owning Bitcoin and Ethereum, but also use the options market to hedge out the exposure for their larger portfolios. Just in 2020, we’ve seen Bitcoin and Ethereum derivatives trading increase by over 1,800%. In the last two years, derivatives have really come to maturation as large exchanges such as CME and Deribit move into the space. By being able to leverage this powerful hedging tool, digital assets are becoming more of an investable asset class — and we want to serve as the trusted investment partner for our clients, helping manage their entrance into the space.”

“Two Prime’s risk-managed fund enables our family office to comfortably add digital assets to our portfolio with peace of mind. We are deeply impressed by the experience of the team and their rational approach to this highly volatile market,” said Fernando Schroeder, spokesperson for Ohio-based family office and Two Prime investor Lone Cypress Holdings.

“Two Prime’s intelligent investment exposure to digital assets allows us to hedge inflation risk for our corporate treasury while protecting against market volatility. It’s a no-brainer for us to work with them,” added Lisa Merrill, Chief Financial Officer of FIXIT Network, an online platform connecting homeowners with vetted, reliable home services technicians.

Through Two Prime’s model, the Fund can generate yield through a combination of short call positions and long put positions to hedge against a downswing, and in turn, protecting returns for investors while leaving the opportunity to take advantage of upside volatility. In addition, at any given time, the portfolio is hedged between 50 to 90% as the fund managers see fit.

At launch, USD $35 million has been committed to the Two Prime Digital Assets Fund I and is open to accredited investors within the U.S. and abroad.