Melon, a blockchain asset management protocol, recently announced its rebranding to Enzyme Finance. Enzyme is a full-featured on-chain asset management platform. Formerly known as Melon Protocol, the token has a new icon and name (Enzyme token), but the MLN ticker and contract address stay the same. MLN is used to pay for various functions throughout the fund creation process and investment lifecycle.

Enzyme Highlights:

- Entirely new smart contract architecture: Allows for much higher flexibility with integrations and substantial gas savings.

- Upgradability: Users can seamlessly upgrade to future Enzyme versions and access the latest protocol updates & features.

- 100+ Asset Universe: Enzyme supports nearly 150 assets to choose from when managing portfolios.

- Lending enabled for Portfolio Managers: Users can enhance performance by earning yields on positions via lending protocols (eg. Compound & MakerDAO’s Chai).

- AMM pools enabled for portfolios: Users can earn trading fees by providing liquidity to AMM pools (e.g. Uniswap), thus enhancing their performance.

- Synthetic assets are live: Users can include synthetic assets in their funds including commodities and stock indices such as sFTSE, sNIKKEI, and sOIL, etc.

- Enhanced trading liquidity is live: Aside from DEX integrations, Enzyme also includes Paraswap as an aggregator in giving fund managers access to much deeper liquidity and higher gas optimizations for trading.

- Shorting: Users can take synthetic short positions through the large range of inverse tokens provided by Synthetix.

- Engage with other users today: Users can now add information about their strategy and team on their own personalized Portfolio Manager page, so that it’s easy to build relationships with a community of investors.

- Farming: Enzyme products can now more easily access farming rewards from external DeFi platforms via plugins.

- Delegating trading to a 3rd party: Portfolio Managers are able to delegate trading to additional addresses and revoke or change that access at any time, increasing their flexibility to manage their trading operation.

- Choose a benchmark: Pick which token to benchmark performance against. Benchmark performance against different fiat-pegged stable coins and more.

- Customize: Users can opt to whitelist certain addresses that can invest in their portfolio and set minimum investment thresholds.

What’s New?

1. New smart contract architecture

Enzyme’s v2 contracts have been entirely re-architected. As a result, the protocol possesses three important new qualities:

- Modularity: Portfolios can access upgrades from new releases while preserving their assets and investors. This is made possible by the modularity of the new architecture.

- Extensibility: The core infrastructure no longer hard-codes knowledge about specific plugins, making it more extensible and composable e.g., it is agnostic to particular price feed implementations, DeFi adapters, fees, policies, etc.

- Efficiency: The protocol shares logic rather than deploying independent instances of the same code making it much cheaper and more efficient to use.

2. Upgradability

Upgradability on Enzyme was designed so that users can easily access new infrastructure or improvements governing how funds work. It also allows managers to change fund/product configurations (e.g. management fees or risk management policies) at certain time periods.

In keeping with the DeFi spirit, it goes without saying that investors in Enzyme strategies are able to opt out (by redeeming) if they don’t agree to the changes. Therefore, at every upgrade cycle, there is a time-lock imposed of 48 hours before the changes come into effect. This parameter can be changed at a governance level. Importantly, getting access to new DeFi integrations (adapters) does not require an upgrade by the user.

3. 100+ Asset Universe

Thanks to the new architecture, Enzyme is able to support a greater number of assets: currently, nearly 150 assets, and this is expected to grow rapidly from here! The asset universe is made up of primitives (plain vanilla tokens) and derivatives (tokens that derive their price from underlying primitives, e.g. cTokens or inverse Tokens).

As long as a primitive price feed is available to the protocol, it can be included in the protocol. Similarly, derivatives that derive their prices from primitives that the protocol already has prices for, can be included fairly trivially too. In summary, users can expect many more assets to be added in the coming months.

4. DeFi Plugins & Farming

Enzyme enables direct composability with lending protocols, AMM pools, aggregators, and synthetic products. This means managers can use a combination of smart strategies to enhance their performance.

As an example, let’s imagine that a portfolio on Enzyme v1 previously held 25% DAI and 25% USDC, and 50% ETH.

With Enzyme, the same fund can lend these holdings out for a year and the new balance would be 25% cDAI, 25% cUSDC, and 50% cETH. At today’s rates that would yield the fund an additional aggregate of 4.4% per annum at today’s lending rates — more than what most traditional funds make in a year! The best part is, users have no long-term obligations here and can exit loans converting them back into the underlying assets at any time.

This fund could additionally claim COMP farming rewards on all three of these pairs because all three of these assets are eligible for the rewards.

Alternatively, Enzyme can now deposit the cDAI and cUSDC into a Uniswap AMM pool and become a provider of liquidity to this pair. There is almost zero impermanent loss risk since they are both stable coins with a theoretically identical dollar value. Yet, Enzyme is now earning 30 bps on all trading that occurs on this Uniswap pair!

The opportunities to play around with different strategies on Enzyme are endless and will grow dramatically as more DeFi plugins are built.

5. Built-in Protections

A major focus with v2 is the security of users. In particular, Enzyme attempts to minimize the trust required by the Portfolio Manager and investor with the use of smart contracts. This is a challenging task and Enzyme has included additional layers of built-in protections to deter bad behavior where possible. These policies can protect against attacks using flash loans, a lack of 24/7 redeemability, and arbitrageurs just to name a few.

Wherever possible, Enzyme tried to automate and recommend the use of such policies on the front-end. Find out more about policies in advanced options or in the Enzyme user documentation.

6. Customisability

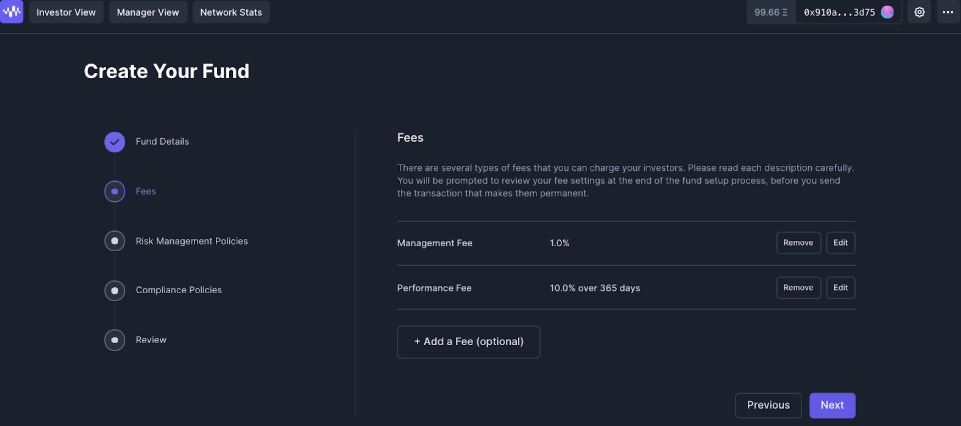

Enzyme v2 will give users the flexibility to customize their investment vehicle with just a few clicks. Decide what fees to be charged, whether to keep the vehicle open or invite-only (whitelisting), and which currency performance is to be benchmarked against. Users can decide to take care of trading on their own or delegate it What the minimum and max investment ticket to accept. The list is growing fast and v2 will enable users to experience how flexible and easy it is to create a new product.

7. Engage With Other Users

With v2, the Enzyme interface will provide a level of (optional) interaction between Portfolio Managers of strategies and Investors in strategies. Managers of strategies are able to go to their Settings page and drop in information about their investment strategy, who they are, and how to get in touch with them.