Cryptocurrency liquidity provider, XHUB, announced today it has signed a joint venture agreement with dual-chain blockchain protocol ByteTrade.

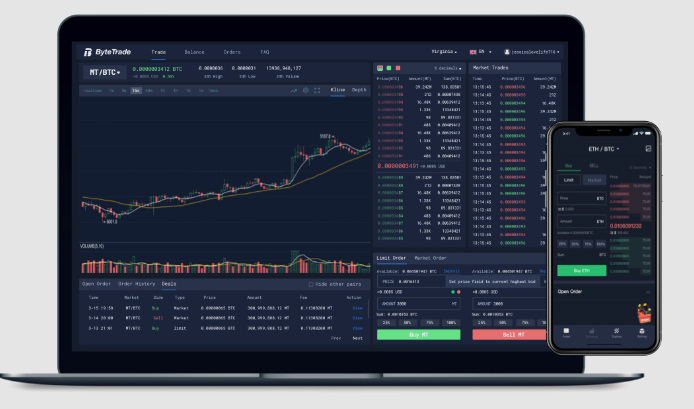

ByteTrade, developed in 2018, employs cross-chain and sidechain blockchain technology. In combination with a proprietary consensus mechanism, the protocols can be used by decentralized exchanges to enable multi-chain trading for quick execution rates, global payment solutions, dApp and DeFi development, digital ID issuance and voting, etc.

XHUB manages one of the largest cryptocurrency liquidity systems working directly with brokers, hedge funds, proprietary trading firms, and exchanges. The XHUB solution provides aggregated pricing from across 130+ cryptocurrency exchanges with consolidated deep level-2 order books, smart order routing flows and physical settlement of fiat and crypto-assets.

Partnership

Through this partnership, decentralized exchanges operating on the ByteTrade Open Network (BTON) blockchain and ByteBulls white-label solution will gain instant access to XHUB liquidity pools.

XHUB, will integrate the DEX trading platform with its own white-label partners, OTC desks & market makers. DEXs released by XHUB will provide cross-chain trading, deep liquidity, fast trade execution and settlement for all clients. Traders will be able to generate unique user IDs secured by their secret mnemonic phrase – thus creating an access system very similar to a centralized exchange yet fully private and secure on the blockchain. XHUB clients will receive features and updates released by ByteTrade as they are developed and rolled out.

The ByteTrade Consensus Agreement consists of two major mechanisms: DRPOS (Delegated-Revenue-POS) and CBP (Consensus-before-Packing).

DRPOS aims to address the root of the low participation problem of blockchain communities. The overall speed of a blockchain network is determined not only by the block time, but also by the confirmation speed of each block. Since subsequent block confirmation is not required under the CBP mechanism, it offers greater network speeds with the block time rate at 1 block per second.

“Decentralised trading platforms are growing in popularity and so is the demand as ownership of funds becomes a huge priority for traders. The ByteTrade platform shortens the learning curve for users which should allow for greater adoption. The focus is on freedom of money and building upon the decentralized, trustless philosophy of blockchain. Through the joint venture, we are going to solve the liquidity problem which is rife on DEXs. It will allow traders to use decentralized platforms with ease, execute large orders without getting shortchanged by the spreads and without the need to rely on centralized third-parties for settlement. Simply said, you will never have to sign up on a centralized exchange ever again.”

– James Anderson, CEO of XHUB

XHUB will add the DEX platform as an offering to its current network of clients which consists of professional traders, institutional investors, hedge funds, brokers and exchanges.

This move will enable trading supported with XHUB’s deep liquidity pool with the security and trust offered by decentralized exchanges.

“ByteTrade’s cross-chain protocol allows us to offer a wider range of assets such as Bitcoin Core (BTC) on our decentralised exchanges and other products. Combined with the dual-chain protocol which executes trades on a sidechain, we achieve faster execution and settlement of trades. Our partnership with XHUB will ensure that we are able to offer as many assets as possible without liquidity being a problem. The smart order routing and matching engine deployed by the team at XHUB is an excellent solution that fits right in. We look forward to working with the team and boosting the adoption of decentralised trading platforms.”

– Peng Peng, CEO of ByteTrade