dYdX, the open crypto trading platform, has announced the introduction of trading fees from March 10. This is in line with the exchange’s new business model aimed at raising revenues to cover gas costs and boosting the provision of liquidity.

As an important player in the DeFi ecosystem, dYdX built both a protocol and an exchange. The dYdX team acknowledged that they are yet to find a successful long-term business model for their protocol. Therefore, they decided to pursue the proven model used by multiple exchanges while they continue to experiment at the protocol level.

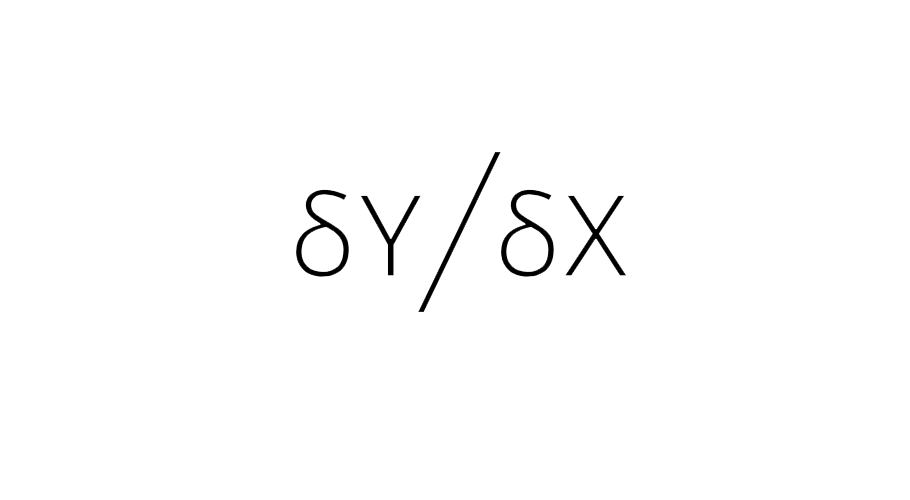

dYdX trading fee structure

The company has decided to base their fees on trade volume; fees will vary for different trading pairs on the exchange. Initially, there will be zero fees for market makers, a move aimed at incentivizing users to open more limit orders; the aim is to add both depth and liquidity to the exchange’s order book.

Taker fees range between 0.05% and 0.5% based on each trade’s value and trading pair. The exchange will charge higher fees for smaller orders as compared to larger ones to minimize transaction costs.

Fees to mitigate rising costs

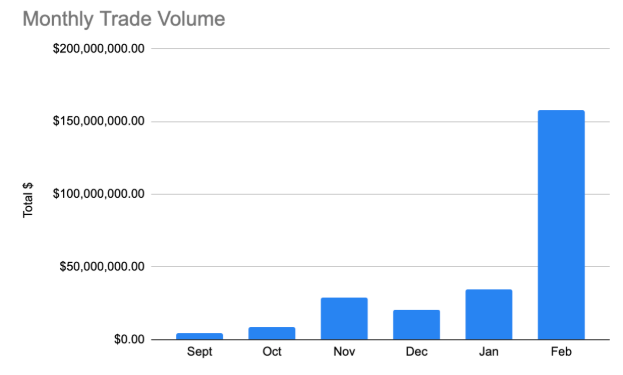

The fees will help cover their transaction expenses, earn revenue and incentivize more liquidity. So far, the exchange has been covering the gas costs for all transactions allowing them to deliver swift and smooth trading experiences. However, the rapid increase in the number of users and trading activity has seen their costs rise proportionately. For instance, the cost for February exceeded $40,000.

The growing popularity of the open trading platform is a result of the continuous creation of useful and valuable products that solve users’ problems. This has been the sole focus for dYdX and now the company intends to build a sustainable business on this foundation. Going live in May of 2019, the platform has highly functional products including P2P lending pool and pooled lending protocol that continue to drive new and consistent volumes.

dYdX is also planning to launch a brand new product within the year aimed at expanding its core functionalities. The company hopes that the growing product portfolio will be sufficient to retain existing customers and that they will continue trading even with the new fee structure in place.