Radius Bank, an FDIC insured virtual bank, today announced a strategic partnership with iHuddl, a platform providing access to investment products and services, see whitepaper for more details.

Leveraging Huddl’s social financial platform and app, the partnership will offer two of Radius’ accounts to Huddl’s customers: High Yield Savings and Hybrid Checking.

This long-term partnership between Radius Bank and Huddl represents our commitment to ensuring every consumer has equal access to essential banking and investment products and services. We’re excited to see where this partnership takes us and look forward to the innovation ahead.”

– Mike Butler, CEO of Radius Bank

Huddl’s consumer-to-business social marketplace for banking and investment products and services is a platform built to make the delivery of complex financial products and services frictionless. Users’ money is seamlessly pooled together to unlock collective buying power, giving access to essential banking and investing opportunities, such as global stocks, checking with interest, private equity funds, global bonds, hedge funds, cryptocurrency, and more.

“We’re excited to have Radius as a long-term partner as today’s announcement represents the beginning of a fundamental shift in global financial services,. Technology and blockchain innovation now allow us to break down barriers and remove friction for both consumers and financial firms, to ensure everyone has equal access to essential financial products and services in a seamless, safe and supportive environment. By expanding digital delivery models in new and innovative ways, financial firms of all types can now deliver a broader set of products and services directly to customers of all income levels across both urban and rural communities.”

– Stephen Corliss, CEO of iHuddl

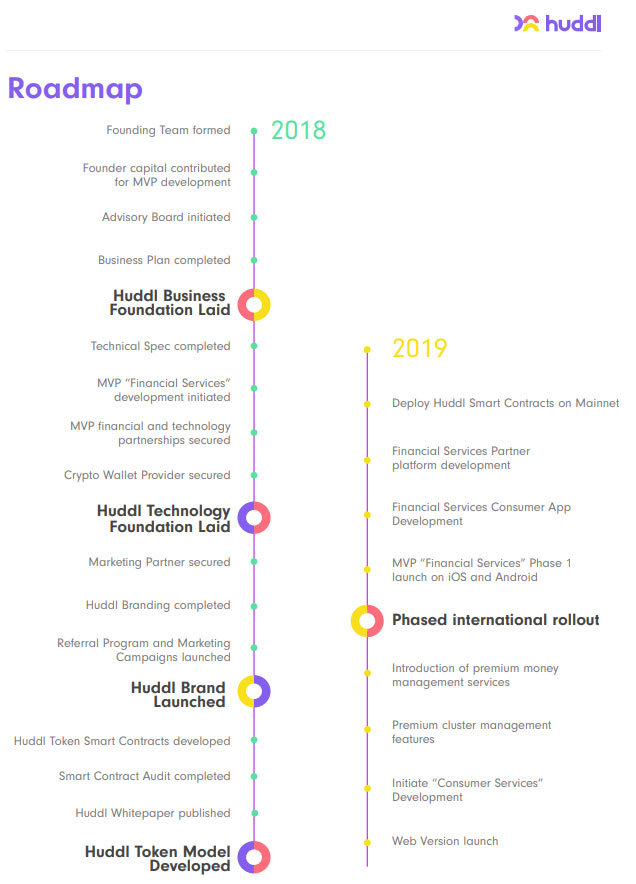

See Huddl’s roadmap below, and whitepaper for more details on the platform.