Cryptocurrency is becoming popular with every passing day and more people are opting to invest in it. Research shows that the value of cryptocurrency market is increasing constantly, growing 91% from the beginning of 2019. Bitcoin remains the cryptocurrency of choice for many investors, beating competitors by a long margin.

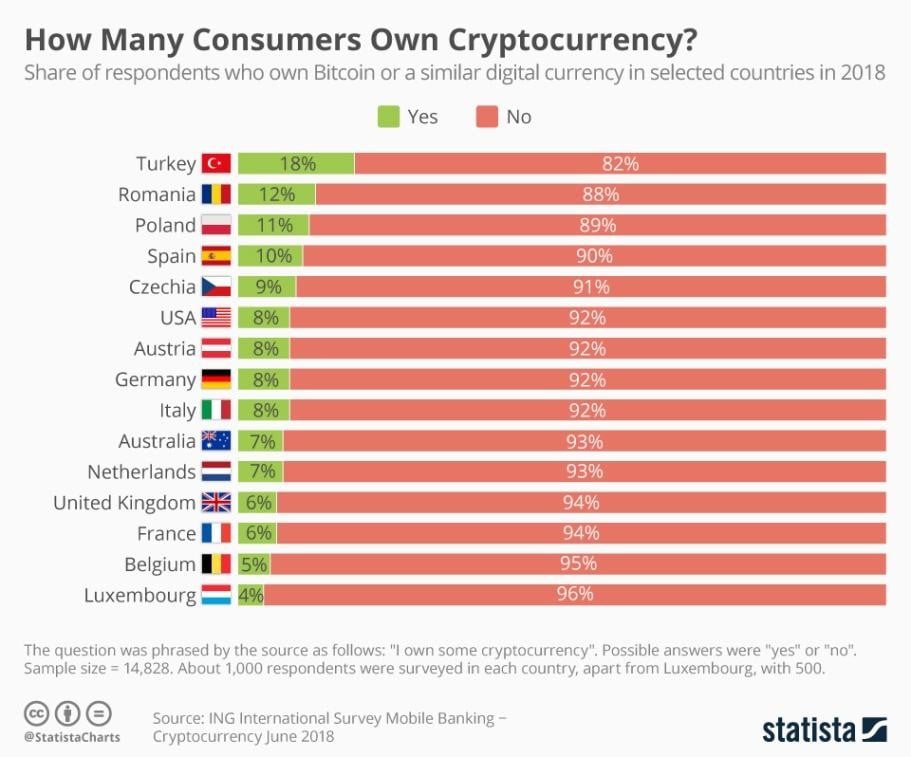

The following image shows the market share of individuals from countries around the world who claim to own cryptocurrencies.

Looks good right? However, before you dive headfirst in the sea of cryptocurrencies, there are some factors that can help you learn how to invest in Crypto.

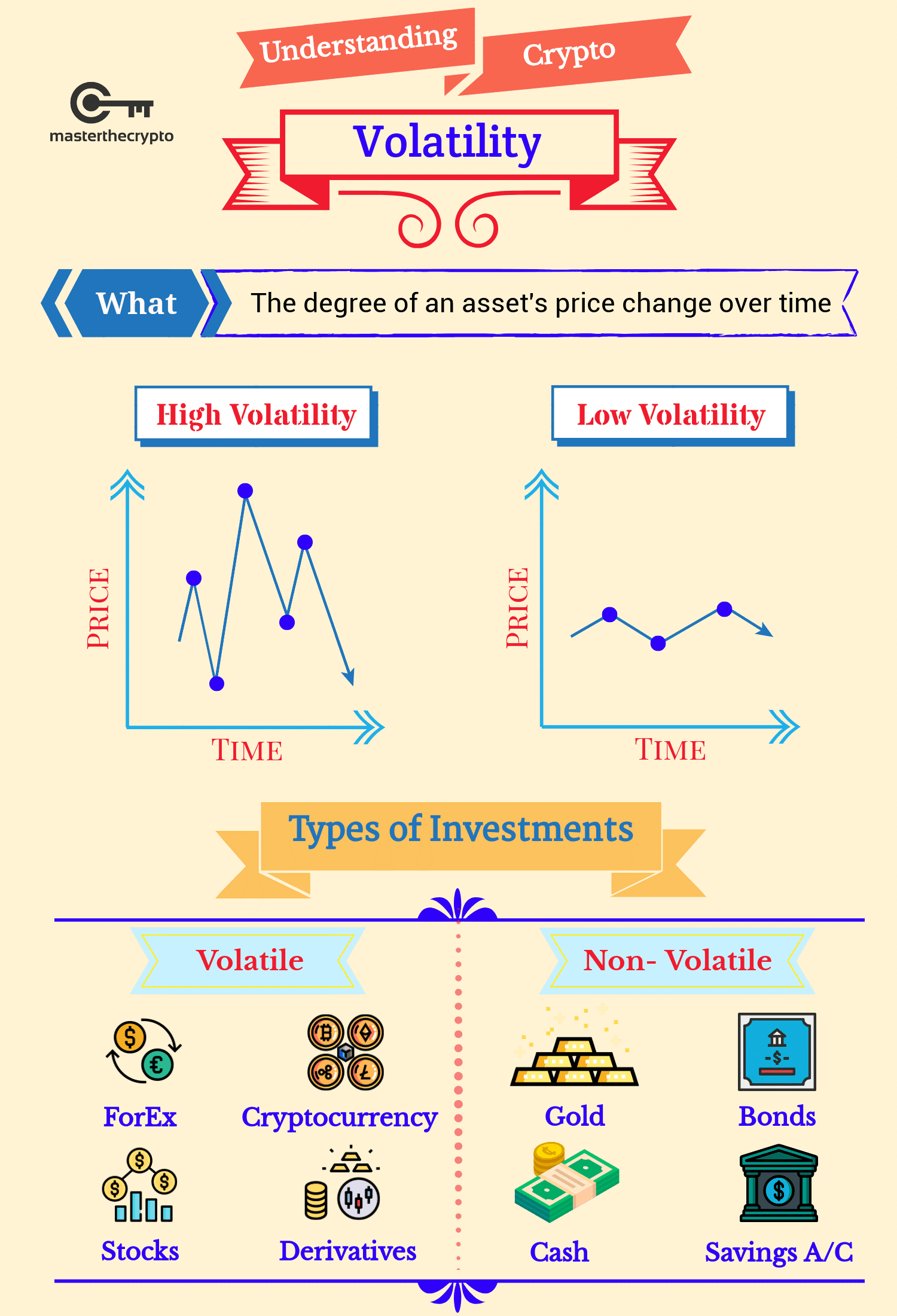

1. Market Volatility

When it comes to investing in digital currency, you have to face the risk of the market crashing suddenly. Studies show that the cryptocurrency market is highly volatile. However, high risk investments often return the most profits as well. The following image depicts the concept of volatility.

2. Risk Tolerance

You should always invest carefully and never put all your savings in one investment. Since cryptocurrency is a highly volatile market, invest only a small amount and monitor the progress of your cryptocurrency closely. According to studies, some individuals have suffered billions of dollars by investing too heavily in digital currencies.

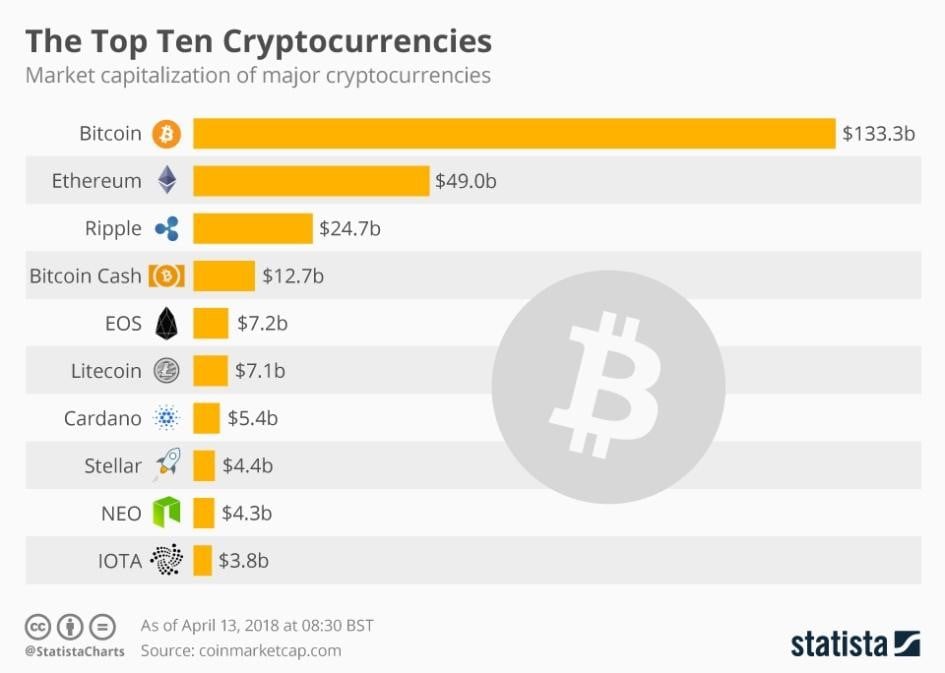

3. Market Capitalization

It is wise to know the size of the venture you are investing in, and the same applies to cryptocurrency. You can calculate the market capitalization of each cryptocurrency by multiplying its circulating supply with its market price. This would tell you whether you want to put your money in a specific cryptocurrency or not.

The image below shows market value of the most popular cryptocurrencies.

4. Circulating Supply

Circulating supply refers to the number of coins available and circulating in the market presently. You might find it challenging to monitor the circulating supply of a cryptocurrency upon entering this market. However, research indicates that it is a good idea to find out the circulating supply of a cryptocurrency before deciding to buy it.

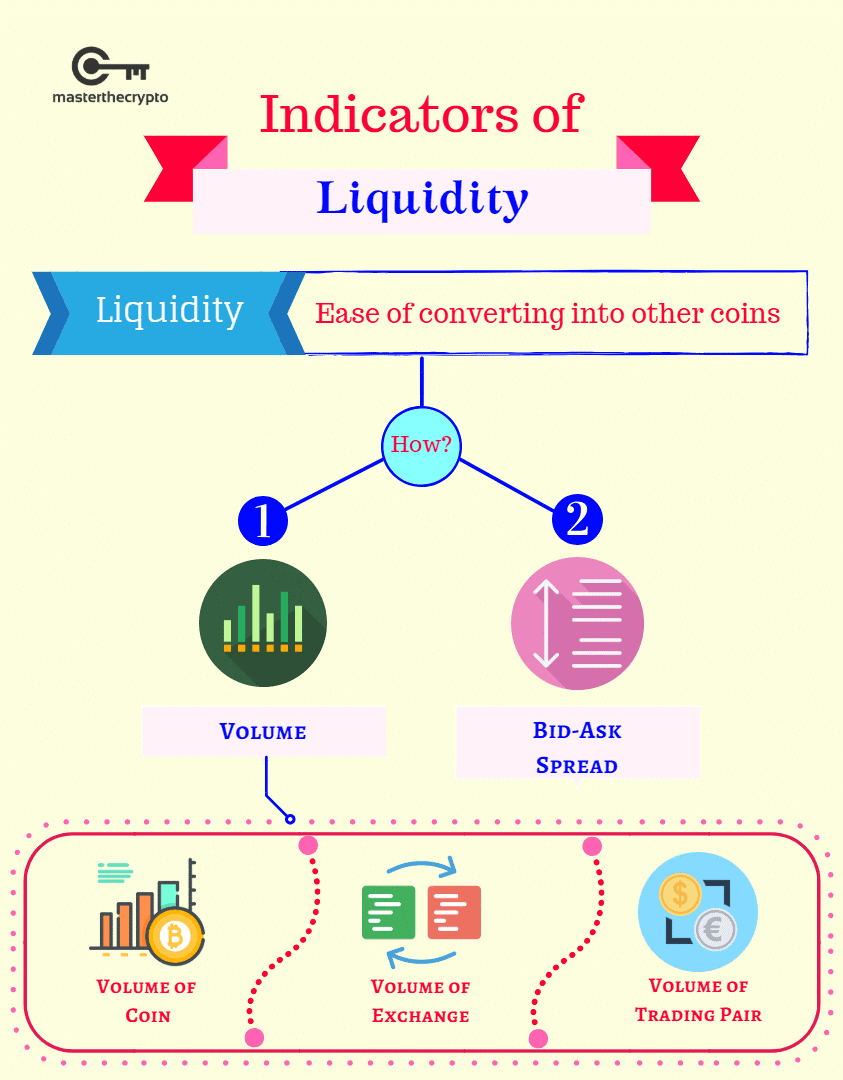

5. Liquidity

Most of us are investing in cryptocurrency because we want to increase our assets. Liquidity refers to the degree to which cryptocurrencies can be bought or sold without causing drastic changes to their market prices. You should consider the liquidity of cryptocurrencies before buying them.

The following image shows the indicators of liquidity of cryptocurrencies.

6. Developer

You must track the development activity of any cryptocurrency that you are thinking of buying. This is important because the developers of some cryptocurrencies are not maintaining them any longer. Such cryptocurrencies are unlikely to progress any further.

You can check the development of cryptocurrencies through public source code repositories such as Github, Bitbucket, etc.

7. Community

It is a great idea to see the strength of the community supporting a particular cryptocurrency. Strong community support for a cryptocurrency usually indicates better features, higher trading volumes, and larger growth rates. Studies reveal that cryptocurrencies with the most active community support to progress the most.

8. Popularity

You should check the popularity of a cryptocurrency before investing in it. It is a safe bet to pick the most popular cryptocurrency. You can check the popularity of a cryptocurrency by going through search engine results.

The image below shows the top ten cryptocurrencies by popularity currently.

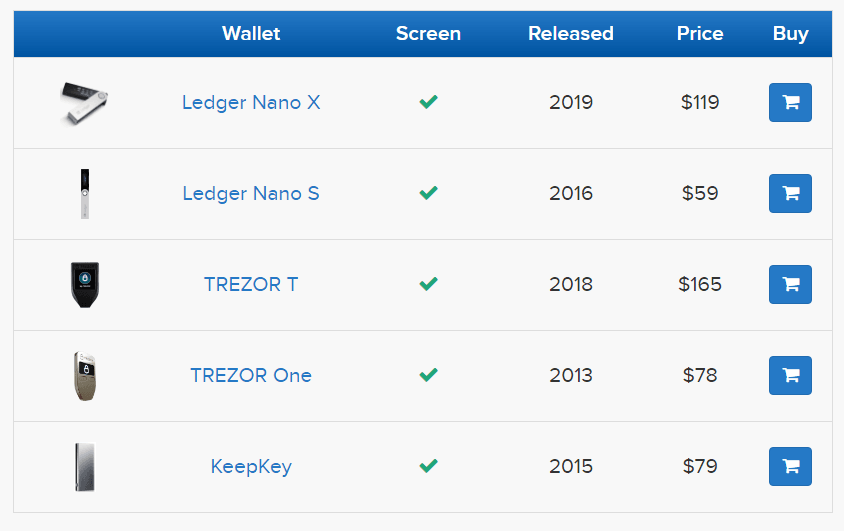

9. Storing Cryptocurrencies

When opting to buy digital currency, you should also consider where you will store it. Digital currency wallets are available to investors where they can store their cryptocurrencies. These wallets are in the form of either hardware or software. They are usually applications that save the record of your digital currency holdings.

It is important to choose a digital wallet that keeps your cryptocurrency safe. This is to ensure that you don’t lose all your digital currency investment due to a security breach.

The following image shows the top 5 Bitcoin wallets.

10. Tax

Prior to entering the digital currency market, it is also imperative to check the tax implications of your investment. Different countries tax cryptocurrencies differently. You might want to consult an accountant about the tax you have to pay on your income from digital currencies. It would save you from unnecessary problems in the future.

Conclusion

Now that you have read the things to consider before investing in cryptocurrencies, you are more aware of what to look for when buying them. You also know how to protect yourself from the perceived risks of investing in cryptocurrencies. So now you can start thinking about making an investment in cryptocurrency.