Lenders in emerging markets struggle to make loans to small businesses and informal sector borrowers because they typically have little to no credit history or traditional financial documentation.

LendLedger aims to solve this information gap using open APIs, Stellar blockchain technology, and the LOAN digital asset token.

Using distributed ledger tech, LendLedger is developing a “trustless” open lending network. A blockchain is particularly well-suited to create trust between participants who don’t know each other.

Anytime a smart contract is executed on the blockchain, information is recorded to the public blockchain ledger. There’s no central administrator and no gatekeeping. Any information logged to a blockchain is public and permanent, keeping all participants accountable.

Problem:

A grocery store owner in rural India, with no credit history, needs a small loan.

How can the bank trust that the business owner will repay?

Without a file at the credit bureau, a grocery store owner in an emerging market is invisible to the traditional lending system.

However, he does use multiple digital services that collect vast amounts of financial data on him and his business. He may pay his mobile data and utility bills via a mobile wallet, and he uses a mobile Point-of-Sale (PoS) device to accept customer’s debit cards.

The grocery store owner has a profitable and growing business, which should prove that he is an ideal loan recipient.

These transaction histories could support his creditworthiness to a lender, but most digital service providers don’t share data with financial institutions or credit bureaus.

Solution: LendLedger, Bringing Credit to the Developing World

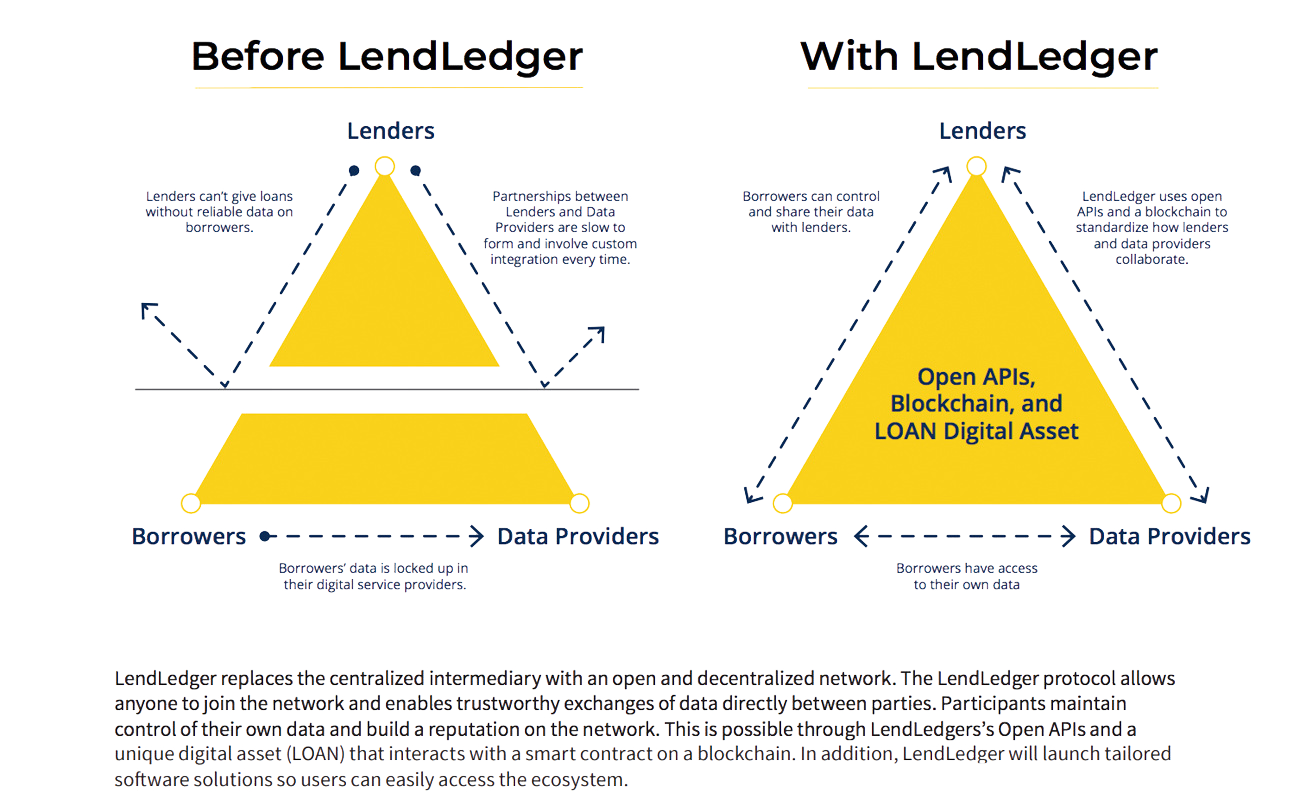

How LendLedger solves this issue is straightforward: Make borrowers’ digital payment data accessible to lenders will bridge the multi-trillion lending gap between institutional lending money and informal borrowers.

The lending market needs an environment of trust and transparency that can connect Lenders with Borrowers’ data and enables tracked repayments over time. When the grocery store owner can securely and verifiably send their Swipe credit data to Mumbai Bank and build their credit reputation over time as they repay the loan, then the informal sector breaks open as an affordable and accessible market.

By unlocking alternative credit data for the informal sector, LendLedger will create a new profitable market for Lenders, Data Providers (DPs), and other service providers.

The open network will enable financial growth in underserved areas as more Lenders will get access to qualified Borrowers through LendLedger. LendLedger is designed to enable an efficient, affordable, and inclusive lending market.

LendLedger Software Solutions

Without any technical expertise, participants can immediately access the LendLedger network through the software. Borrowers, Lenders, and DPs will each have their own software with a user experience customized to their specific needs and role in the network.

The following software solutions are on the current LendLedger development roadmap:

- L-Data: A software solution for DPs to monetize their data on LendLedger. It’s comprised of three main sections: data marketplace, data analytics, and technical/integration portal. L-Data can also process fiat transactions and record blockchain transactions and contracts. DPs will evaluate the software based on the demand for, and revenue potential of, their data, ease of technical integration, as well as analytics and insights that can aid their business.

- L-Lend: A software solution for Lenders to originate loans through LendLedger. It’s comprised of three main sections: origination, loan management, and finance/accounts. As part of this, it also processes fiat transactions, records blockchain transactions and contracts, and performs monitoring and compliance functions. Lenders will evaluate the software based on the volume and freshness of leads, the flexibility of products that can be created, and marketing/engagement analytics and capabilities.

Team

LendLedger was created at Arth Labs, the technology and innovation arm of ArthImpact Finserve, an Indian lending venture. The team draws its expertise from industry bigwigs. Gautam Ivatury is both its CEO and founder. He is a FinTech innovator with vast experience in financial services. He had a stint on Wall Street and previously ran a $26 million Gates Foundation funded CGAP project on digital finance for the World Bank. He co-founded LendLedger with Manish Kheon, who has 25 years of experience in the financial industry. Manish founded FINO PayTech – India’s largest payment service as well as worked with several financial institutions in India.

Other key team players are Stanford graduate Greg DeForest who is the Product Head. He has 20 years experience in building products in Silicon Valley for big corporations among them Yahoo. Odysseas Sclavounis is their researcher on governance in public blockchains while Nick Hughes leads a team of advisors. Hughes is an accomplished leader in the money and finance sphere. He is the 2010 recipient of the Economist innovation award. Other advisors are Ignacio Mas and Albert Jimenez.

The LendLedger LOAN token is currently accepting presale sign ups at lendledgersale.io/presale. Note, LendLedger is currently not able to take contributions from the US, UK, and China.

Learn more on LendLedger ecosystem on the whitepaper and the official website.