Recently, the Securities and Exchange Commission (SEC) and the North American Securities Administrators Association (NASAA) released statements and comments on ICOs. They warned investors against investing in them.

Investors were told to look beyond the hype offered by ICOs and they were also advised to better understand the risks involved in investing in ICOs. Some of the core areas of concern were the high volatility associated with investing in cryptos and instances of fraud. While the SEC and NASAA may have made robotic public statements on the crypto industry, they are not alone in this.

There has been concerted worldwide criticism on ICOs and cryptocurrencies as a whole. The International Organization of Securities Commission (IOSCO) recently stated that investors should be careful when investing in ICOs. The body continued to say that ICOs do not operate on a single jurisdiction so, in the event of fraud, it may be hard to prosecute the perpetrators. In countries like China and South Korea, ICO activities have been outrightly banned. The US and UK are working on legislation aimed at nabbing fraudulent ICOs.

While these concerns and idea legislation are timely, some of them are simply cases of throwing the baby out with the bath water. Granted, there may be challenges here and there, but these are the initial stages of a revolution. The ICO and blockchain industry ought to address challenges they face in a sober and progressive manner.

One ideal way of minimizing risks to investors is offering hedging solutions. When one invests in an ICO/cryptocurrency, protecting the investment can be equally as important as seeing the money grow. When an investor hedges, this acts as a form of insurance.

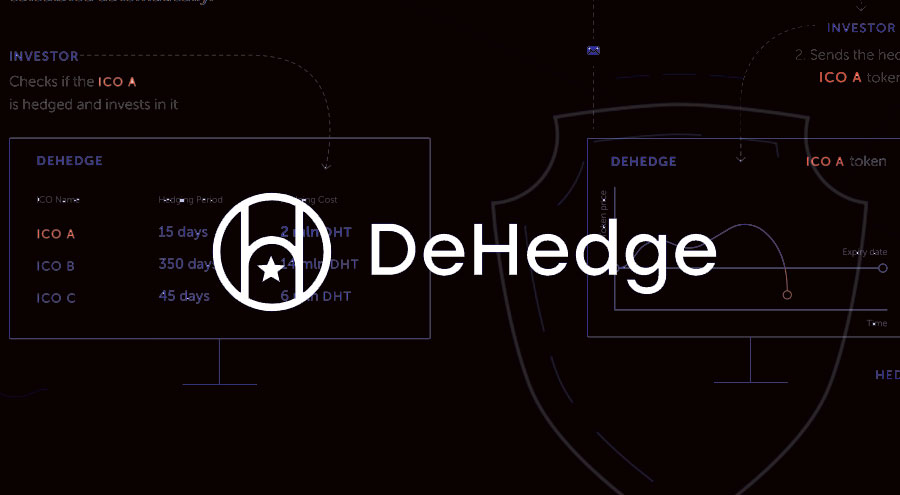

The team behind the DeHedge platform seeks to be the first that offers to hedge on cryptocurrencies and ICO tokens. This platform will offer these services through Ethereum based Smart Contracts.

A good illustration for this is below:

John would want to hedge against ICO XYZ that he has invested in. In the event that the ICO collapses, John will be compensated with an amount that commensurates with the loss suffered. There are two options for which he can receive his compensation. In the first instance, John can get compensated and still retain ownership of the tokens of XYZ. In the second option, John relinquishes ownership of XYZ tokens and gets compensated for the losses fully.

DeHedge also makes it possible for investors to hedge cryptocurrencies that are traded on the secondary market. Since the platform leverages on blockchain technology, investors can easily track their volume of compensation at any one time.

The DeHedge platform is ideal for ICO investors, cryptocurrency traders, ICO projects, and investment funds. The solution offered by this platform is timely since, in 2017 alone, over USD 300 million was lost by investors in failed ICOs.

There is a token sale for DeHedge that is soon scheduled to start for the platform’s native DHT tokens

The presale is set to commence on the 15th of March, 2018, and afterward, the ICO is scheduled to begin in April. These tokens will be used as reserves for hedging. A total of 2.5 billion tokens will be issued during the offering.

The presale (1 DHT = $0.0165 ) will include a DHT bonus of 25% with a $3 million cap, and the main ICO (1 DHT = $0.020625 ) will allow for a $30 million cap with a $300 minimum contribution.

[embedyt] https://www.youtube.com/watch?v=QDhz4ErqUS0[/embedyt]