Cryptocurrencies remain one the most volatile, yet attractive investments today. Still, a single move from the regulators can make the crypto markets look like a bloodbath, so many investors would think of them as risky investments. But there’s already a way of investing in crypto with exposure to real assets. Asset-backed tokens give you the benefits of crypto, such as low transaction costs and transparency, as well as the security of having a physical asset.

The first asset-backed tokens have already appeared. They are linked to fiat currencies, like Tether (linked to USD), precious metals, like Digix, and shares of blue chips, like tokenized Apple, Facebook and other shares currently traded on the LAT platform. The market capitalization of the asset-backed cryptocurrencies may exceed $4 trillion by 2025, and they will account for at least 80% of the total cryptocurrency capitalization as the market develops.

Volatility is a fact of crypto markets

Investing in cryptocurrencies is not for the faint of heart, as these are one of the most volatile assets on the market today. Reaching all-time highs can be followed by impetuous crashes within just a few days. Just like the price of Bitcoin that reached the milestone value of $5,000 on Friday, has fallen almost 13% since.

While Bitcoin is the least volatile cryptocurrency, its weekly volatility reaches up to 60% per annum, and the other coin pairs show even bigger swings. That, for sure, repels lots of conservative investors from the market. Along with a tightening regulation of the blockchain industry.

Regulation is coming

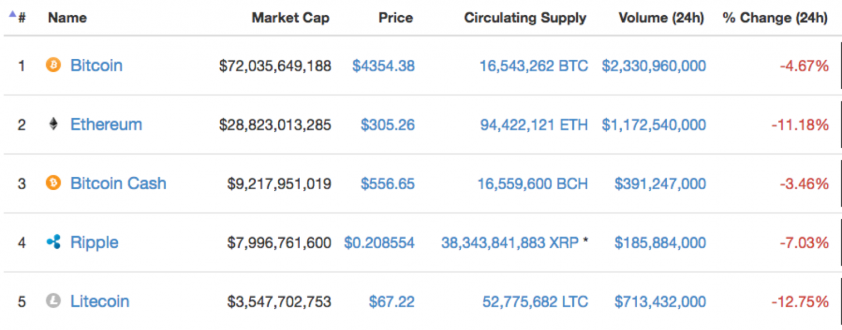

This time cryptocurrency prices are in the fall because of the after a new ruling from Chinese regulators, banning ICOs and asking for all related fundraising activity to be halted immediately. The directive made no mention of the major cryptocurrencies. But their prices tumbled immediately: Ethereum, widely considered the biggest beneficiary of the ICO boom, was down more than 12%, and Bitcoin was down 7% as China is the country where 42% of all Bitcoin transactions have accounted for this year.

Chinese regulation comes as one of the strongest regulatory challenges so far to the burgeoning market for digital token sales, but not the first one to crash the market. In the beginning of August, SEC had officially confirmed it was looking into regulation of cryptocurrency ICOs and warned that ICOs may be considered securities. Singapore quickly followed suit.

It’s obvious that regulators are trying to prevent investors from losing their money to scam projects. But can they stop the development of the newborn crypto economy?

Still a very attractive investment

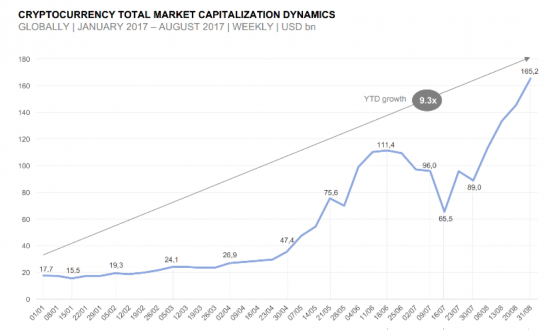

While volatility and the tightening regulations may be off-putting, the returns on digital asset classes remain extremely attractive to investors. There’s no other asset class in the world that could’ve given you the historical performance of this sector. To put things into perspective, in the beginning of 2017, Bitcoin was priced at around $970 and Ether at roughly $8.

The historic performance is not a representative of future earnings, but our estimation is that by 2025 the total capitalization of cryptocurrencies will exceed $5 trillion, as crypto wallets penetration will reach 5% of the world’s population. It’s a pretty conservative estimate, compared to some of the market forecasts. Peter Smith, the CEO of Blockchain, and Jeremy Liew, the first investor in Snapchat, said that the market capitalization of Bitcoin alone may explode to $10 trillion by 2025.

With such perspective, not many people would like to go back to fiat. And there’s already a way for them to hedge their crypto investments with real assets without converting. The rise of asset-backed cryptocurrencies let you have both – the security of having a physical asset and the convenience of a crypto.

Asset backed tokens to drive industry growth

Asset-backed cryptocurrencies have their value linked to real-world assets, such as equities, commodities or fiat money. There are historical analogs of the way they work. Centuries ago, you could park some gold with a goldsmith, and receive an “I Owe You” note from them. These notes could be transferred from person to person, and anyone holding it could go back to the goldsmith and claim the actual gold.

Asset-backed tokens are the digital equivalent of those notes. They are claims on the underlying assets, that get passed between people, while all the transactions are recorded on the blockchains. They have benefits of crypto, such as low transaction costs, security, trustless exchange and smart contracts functionality. At the same time, they are a good store of value by design since their volatility is lower, and they are more predictable and less risky. These assets are more likely to be favored by the regulators as they have a valuable collateral behind them.

The first asset-backed tokens, linked to fiat currencies, precious metals, shares of blue chips, and commodities have already appeared. Our estimation is that the market capitalization of the asset-backed cryptocurrencies may exceed $4 trillion by 2025, and they will account for at least 80% of the total cryptocurrency capitalization as the market develops.

That will make the tokenized assets platforms, that significantly reduce costs of creating such tokens, help their spread and offer significant diversification and portfolio optimization opportunities to crypto holders, the leaders of the blockchain industry.