Coinpit, a brand owned by Seychelles registered company edge.sh Ltd. is looking to lead the future for a new generation of cryptocurrency and bitcoin-based derivatives exchanges. The platform is 100% identity theft-proof, requiring no KYC. There is no need for username, password, photo-id, address proof or even email to start trading. The platform’s technology ensures privacy and prevents AML by disrupting layering instead of relying on expensive and intrusive KYC.

Features soon to be implemented will enable trade from hardware wallets, and all user actions will have a signature from the user key. In addition, data flow from users’ action to P&L to the end settlement will be verifiable using cryptographic proofs. Currently, all contracts go up to 100x but we learned exclusively from Coinpit CEO Bharath Rao, the platform is soon looking to offer 200x on BTC/USD.

Those features blow many current platforms away, but the Coinpit project is just getting started. Tech gurus, such as Mr. Rao continue building trading technology for blockchain assets with the most cutting-edge and streamlined technology. As the blockchain trading ecosystem continues to evolve with more innovative companies competing for space, Coinpit looks to be a standout leader well into the future.

We spoke this week with the Coinpit leader regarding the business, the full interview is below.

You previously announced plans to list other top cryptos and crypto versions of traditional commodity contracts such as oil, gold, and silver, is any progress being made there?

BR: From a technical perspective, everything is in place. From a business perspective, we are working with market makers to quote these products and will offer as soon as we find interested market makers.

What is your view on tether dollar?

BR: It’s a very useful product that acts as a gateway between fiat and crypto. There is some regulatory risk since the U.S. government has a history of shutting down products that are 1 to 1 pegs on USD. We hope they resolve their issues soon.

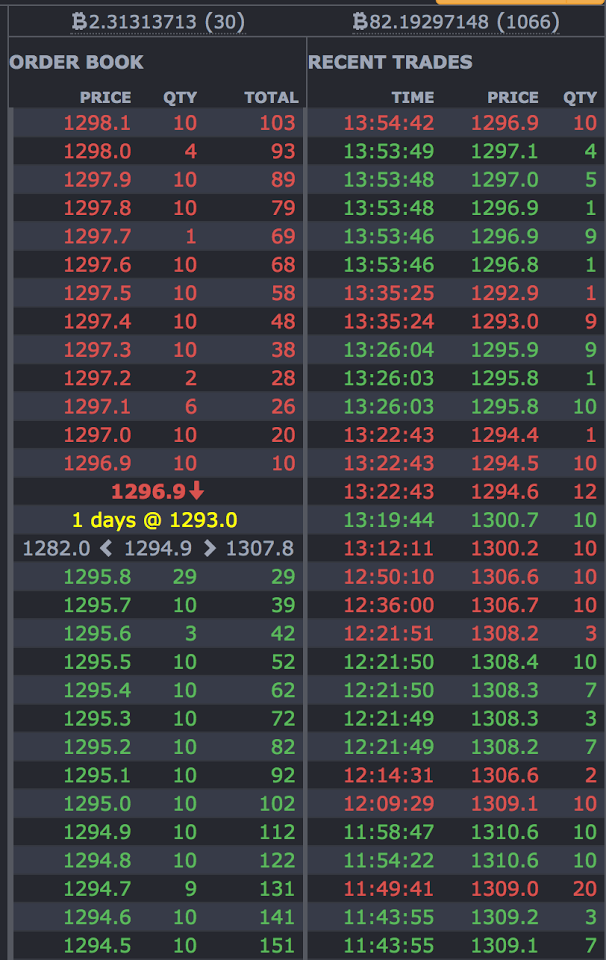

How much volume is the exchange averaging per day?

BR: Currently about 140 BTC/24hrs.

Do you have plans to provide the software to others looking to offer a bitcoin futures platform?

BR: Currently, no active plans to pursue licensing to anyone else at present. However, we perform consulting and technology development to a variety of financial companies in the area of crypto and blockchain technologies.

Is mobile trading supported?

BR: Mobile support will be added over the next few months.

Do you see developing a desktop version of the software?

BR: The platform is API based and alternative clients can be easily developed with or without our help. API documentation is at https://coinpit.io/api.

What is your background in trading, technology, and financial services?

BR: I have traded futures for 6 years and have worked in technology for over 20 years of which 10 years were on wall street. I have a good understanding of trading from both sides of the fence.

What risk management techniques and technology does Coinpit deploy?

BR: Coinpit measures risk precisely using mandatory stops that are guaranteed to fill within a pre-determined tolerance. Triggered stops are also filled before any other trades ensuring no or low slippage. This enables us to offer leverage to unprecedented levels.

Listed as the price in the company contract specs is the spot anchor rate comprised from a median of OKCoin, BitFinex, Gemini, GDAX, and Bitstamp. In light of OKCoin and Bitfinex being removed from a number of indices, do you also plan adjustments to your index? Why not outsource the price feed?

BR: If the prices on reference exchanges diverge too far from the median, we may drop them. We are also looking to add BTC-E, ItBit, and Kraken. We wanted a robust index that everyone could replicate. Current volume-weighted indices are highly susceptible to exchange shutdowns, failures and price anomalies. We would gladly use any robust open-source index by a competent provider.

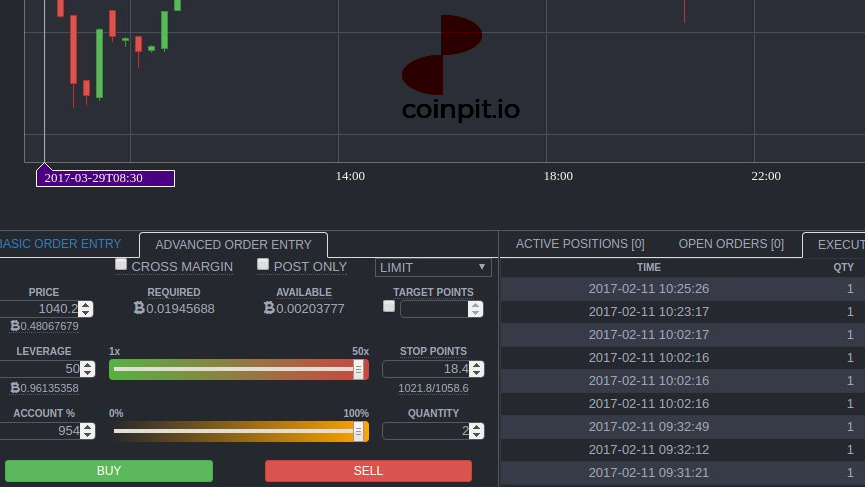

How detailed is transaction cost analysis and real-time P&L?

BR: The full account and position-wise P&L, leverage and account equity are shown in real-time (screenshot below).

Coinpit aims to be an exchange that mitigates the most severe fiduciary risks on crypto-exchanges, assuring that a security breach cannot compromise user’s funds. The exchange is immune to failure from theft from internal or external agents.