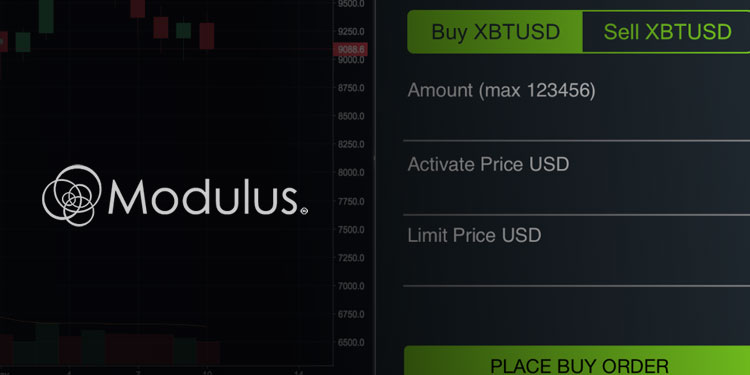

Modulus, a US-based developer of trading and surveillance technology that powers global equities, derivatives, and digital asset exchanges, today announced that it has launched its new Futures & Margin Exchange Solution, featuring advanced margin calculation capabilities and allowing for the automatic management of initial and maintenance contract margins, deleveraging, risk, and much more.

“There’s nothing on the market that’s quite like what we’re offering,” noted Richard Gardner, CEO of Modulus. “When you talk to futures traders about the technology we’re bringing forward, they’re excited about all the practical applications. Our solution is equipped to handle situations that other financial technologists have never even considered.”

Modulus is limiting the number of proffered futures and margin exchange licenses to fifteen for the foreseeable future, in order to allow time for regulators to catch up with the emerging technology and to ensure that the market is not oversaturated.

The solution includes an Auto Deleveraging Engine, which controls trader positions after liquidation. If the liquidation cannot get filled after the mark price reaches the margin-call price, the system will automatically deleverage the counterparty’s positions by profit and leverage priority. The price the positions are closed out at becomes the margin-call price of the order that was liquidated initially.

The Modulus Futures & Margin Exchange Solution’s Insurance Fund is designed to prevent the automatic deleveraging of positions. The fund can be used to attack unfilled liquidation orders before the orders are processed by the auto-deleveraging system. Funds are accrued from liquidations that could have been executed at a better price than the bankruptcy price for a position.

“As one of the most trusted names in the industry, Modulus developed this platform with ultimate precision, ensuring that margin and liquidation calculations are never inaccurate — not even by a fraction,” touted Gardner. “We perform all calculations in real-time. To accomplish this, we’ve customized our matching and risk management engines, which are world-renowned for being the fastest ever invented, and built proprietary margin calculation and deleveraging engines utilizing Golang. The technology, as well as what it enables exchanges to do, is truly groundbreaking.”

Modulus is known throughout the financial technology segment as a leader in the development of ultra-high frequency trading systems and exchanges. Over the past twenty years, the company has built a client list which includes NASDAQ, Goldman Sachs, Merrill Lynch, JP Morgan Chase, Bank of America, Barclays, NASA, Siemens, Shell, Yahoo!, Microsoft, Cornell University, and the University of Chicago.