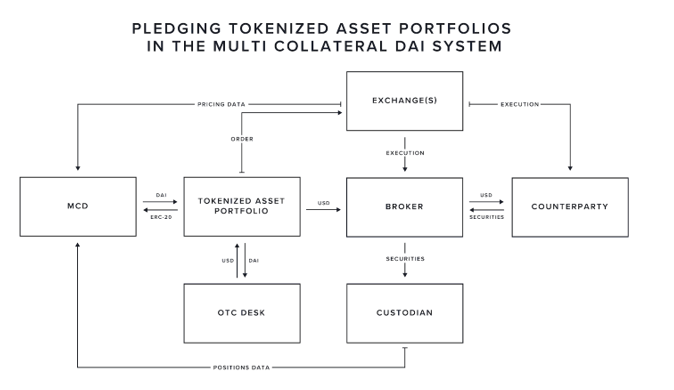

Fluidity, creators of the AirSwap decentralized exchange protocol, has introduced The Tokenized Asset Portfolio (TAP), a standard model to enable real-world assets to be pledged as collateral in decentralized credit facilities, including the MakerDAO multi-collateral Dai system.

Fluidity has executed a pilot transaction to demonstrate how the TAP works, pledging U.S. Treasuries as collateral for a CDP loan on the Kovan testnet.

MakerDAO has laid the groundwork for collateral-based lending on Ethereum. Fluidity believes that a transition to multi-collateral Dai, where multiple asset types other than Ether are accepted as collateral, will fuel the growth of a new and more open financial system built on Ethereum, with MakerDAO acting as a decentralized central bank. For that system to reach its full potential, Fluidity believes that real-world assets should be introduced as collateral to help scale the demand for Dai while also keeping it stable.

To that end, Fluidity has developed a model to allow borrowers to obtain leverage on real-world assets from a decentralized credit facility like MakerDAO’s. To demonstrate this capability, they have executed an end-to-end pilot transaction in which we borrowed Dai from a CDP on the Kovan testnet using U.S. Treasury securities as the underlying collateral. In doing so, they have illustrated the specific steps involved in leveraging real-world assets on-chain, and have demonstrated the tangible value in doing so.

As quoted by the company in a recent post, “We believe this model provides the legal and technical infrastructure necessary to help a decentralized financial (DeFi) system continue to scale. Because it allows traditional capital markets to tap into DeFi-sourced credit with potentially competitive loan terms, we believe it will incentivize these institutions to pledge stable assets (like U.S. Treasuries) into the basket of assets that backs Dai, creating a virtuous cycle. As more stable assets are pledged to back Dai, the more competitive the loan terms can become. And the more competitive the loan terms become, the more stable assets will continue to flow into the basket to back Dai. As the flywheel begins to spin, the demand for Dai should scale alongside the quality of the collateral backing it, allowing it to eventually become the primary currency of the decentralized financial system.”

Fluidity’s goal is to bridge the gap between the traditional capital markets and the growing ecosystem of open, decentralized financial applications, enabling the free and efficient flow of capital between the two. While these applications are emerging rapidly, they remain largely inaccessible to the vast majority of individuals and institutions that lack blockchain-specific technical knowledge and skills. Fluidity aims to connect these two paradigms, allowing DeFi to expand at ever-increasing rates, while also expanding access to financial services for legacy participants.