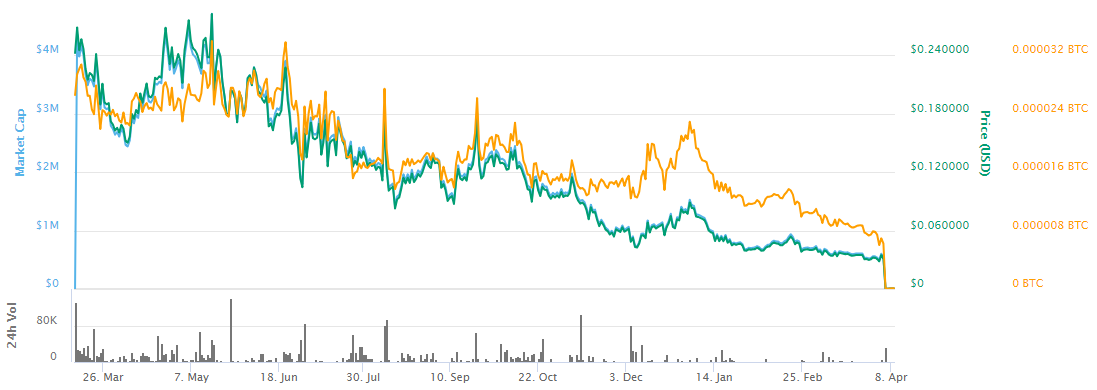

Sharpe Capital, a project developing an open-ended crypto wealth management fund, combining algorithmic trading and venture capital-style investing, has announced the closing up of operations. The platform’s SHP tokens plummeted in the wake of the announcement and are now worth nothing. SHP could be bought using the Bancor Protocol, IDEX, ForkDelta, and Liquid.

The note left by Sharpe Capital leader Lewis Barber, noted a series of trading losses with capital meant to be used for operating the business. Due to the hit, the operating capital dried up and the operation could no longer continue without a significant investment.

The head of the project, Lewis Barber left a note users, and it can be read in full below:

It is with the deepest sadness and regrets that I write today to inform you that Sharpe Holdings Limited (commonly known as ‘Sharpe’) is ceasing operations with immediate effect.

Towards the end of 2018 it became apparent that with high running costs and no significant revenue streams, coupled with continued declines in the cryptocurrency markets, we would need to establish a form of recurring revenue to survive throughout 2019 and beyond. As such, I volunteered to trade crypto futures products using an allocation of our remaining working capital, in an attempt to boost our balance sheet and provide a temporary source of income whilst we finalized the ongoing R&D of our trading algorithms — as many of our followers will know, this was taking longer than expected at the time. I shouldered this responsibility — in addition to my wider responsibilities managing the development team in London — due to relative success I have had in the past, and considering other efforts to establish revenue streams had so far not proven effective.

Unfortunately, despite experiencing some periods of success, the pressures of using this income to support the operational costs of the business ultimately became incredibly overwhelming. This resulted in a series of poor trading decisions causing significant capital losses, beyond the point from which it was possible to recover. I made these decisions on my own recognizance, under the immense pressure of trying to support the team while realizing the ambitions of the Sharpe Centuri product suite, and I failed to share an accurate picture of the situation with the team in a timely manner. I accept full responsibility for the consequences of my actions, and offer my sincerest apologies to the team, the shareholders and the community of Centuri users.

As many of our followers will know, many months and significant resources have been spent on research and development of automated market making and high-frequency trading strategies in cryptocurrency markets. This has been a long, difficult process, throughout a period of constantly evolving market conditions. To put this into perspective, the price range for Bitcoin over this period is as follows; 6k -> 7.4k -> 6k -> 3k -> 5k. Additionally, during this time, the volatility of the market has experienced huge variance, further complicating the development process.

Notwithstanding these challenges, the team has performed an incredible job under extremely trying circumstances and amidst difficult market conditions. At the time of writing, we have a series of back-tested trading algorithms that present themselves as prime candidates for capital deployment. Unfortunately, without sufficient liquid capital to continue operations, the business is currently not in a position to realize the value of the intellectual property that everyone has worked so hard to create. As such, the business will become dormant, but remain the owner of a number of illiquid assets, as well as owning the intellectual property associated with our HFT R&D, and the Centuri platform product suite.

As and when the liquidity situation changes, I will review the best course of action and make an announcement accordingly. Every effort will be made to continue operations if it becomes practicable to do so. I would like to take this opportunity to thank the community for their support to date, and hope to be able to continue the development of our product suite under new leadership, as and when the company may be in a position to do so.

Yours truly,

Lewis Barber