MARKET Protocol has announced its latest partnership with ChainLink, a leader in decentralized oracle networks and securely providing data to smart contracts. Oracles are crucial for inter-blockchain and off-chain functionality; they are key for the inclusion of all asset types on decentralized derivatives trading systems.

This partnership is advantageous not only for MARKET Protocol and ChainLink but also for the entire derivatives industry. ChainLink’s reliable and secure network connections will enable MARKET Protocol derivatives traders to create highly complex derivatives smart contracts.

MARKET Protocol contracts can now be made using any/all market data, on-chain events, and off-chain events, which will allow them to become an excellent alternative to legacy derivatives contracts.

ChainLink and the Use of Oracles

A partnership with ChainLink benefits MARKET Protocol and its platform users by strengthening the reliability through the decentralization aspect of the platform’s protocol and derivatives contracts.

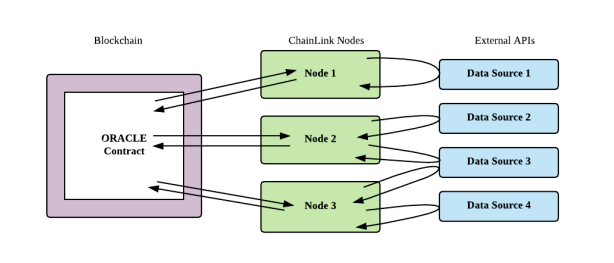

Because decentralized systems are dependent on the honesty of their nodes to achieve a consensus with the most truthful outcome, ChainLink utilizes a system that prevents potential issues resulting from faulty nodes. ChainLink handles the risk via three basic complementary approaches: Distribution of data source, distribution of oracles, and use of trusted hardware.

An “oracle” is used to assure secure interaction to effectively allow private and public blockchains interactions. ChainLink is a leader in decentralized oracle solutions and their expertise is a perfect fit for MARKET Protocol’s development of a platform that securely utilizes off-chain market data, cross-chain events, and on-chain trading relationships for any asset class.

MARKET Protocol

MARKET Protocol’s vision is to bring the $100+ trillion derivatives market to the blockchain by powering the safe, solvent and ‘trustless’ derivative trading of any asset.

Users can trade stocks, cryptocurrencies, and traditional assets with MARKET Protocol smart contracts. MARKET Protocol is open source, allowing users to create decentralized exchanges (DEX) and decentralized apps (dApps) of their own.

There are many additional ways in which derivatives traders can benefit from using MARKET Protocol:

- To purchase crypto assets through the use of smart contracts.

- To trade ICO tokens before they are officially distributed or have begun trading.

- To allow traders to decouple price volatility from the token utility.

- To eliminate the need to manage multiple wallets or exchanges, thereby enabling safer trading.

- To trade non-crypto assets, including stocks (TSLA, AAPL), commodities (oil), or even kitchen spices.

- To short crypto assets, earning a profit from declining prices without the need to borrow the asset.