DeHedge, a startup that offers infrastructure to protect cryptocurrency investors is now well into their token generation presale event for DHT tokens, set to end on April 20th. The team has now collected over 1,500 ETH during the 5,000 ETH hard capped presale. Backers and contributors are taking advantage of a favorable 25% incentive opportunity to accumulate more tokens. Currently, 1 ETH buys 36,000 DHT and 1 BTC buys 490,000 DHT.

After the presale round, 1 ETH will buy 28,800 DHT and 1 BTC will buy 392,000 DHT. The public ICO will have a hard cap of 50,000 ETH. The funds received from the DHT token sale will be used as reserves to cover future hedging compensations. What is exciting is that the beta of the token sale hedge product is already live with users able to purchase project tokens with hedging for up to 6 months.

Read more about DeHedge and the DHT token below:

Offering Two Type of Hedging

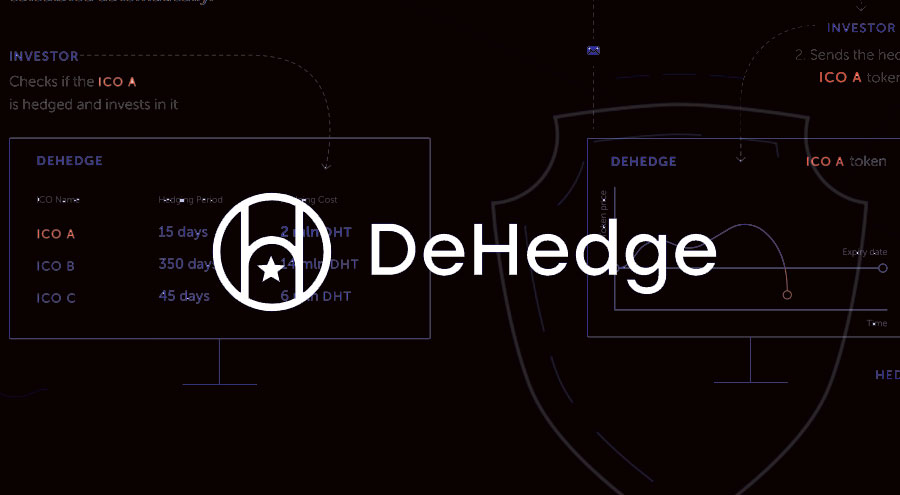

- For ICO Investors – DeHedge hedges the initial exchange rate of project tokens. If the rate falls during the hedging period, DeHedge reimburses the initial offering price in exchange for the project token. Thus, your maximum losses are equal to hedging compensation. DeHedge offers hedging coverage for two types of projects: 1) Pre-Sale and sale projects, i.e. projects the tokens of which do not circulate in the market; and 2) Projects the tokens of which are traded on crypto-exchanges.

- For Cryptocurrency Traders – DeHedge offers protection against exchange rate falling on cryptocurrency exchanges. If the rate falls during the hedging period, DeHedge automatically pays back the hedging compensation. Your maximum losses are equal to hedging compensation. DeHedge receives information about the drop in the rate of tokens via a crypto-exchange API, where the tokens that an investor has chosen to hedge are listed. The settlement function of claims for compensation of losses is automatic. The hedge compensation is paid through the Ethereum smart contract. Hedging payment is sent to the wallet details of the hedging purchaser.

Any hedged transaction is made in the form of a smart contract and coverage is formed to suit it, ensuring compensation of losses incurred by an investor in accordance with the hedging scenario. DeHedge’s smart contracts ensure financial operations of the platform. In case of a hedged event, DeHedge compensates its token owners automatically and in full.

DHT Utility Token

The DeHedge Token (DHT) is a commodity and an essential part of the platform. It is used to pay the hedging premium, which triggers the creation of a blockchain record testifying the hedging.

With DHT tokens you can buy hedging. A DHT owner chooses the project, the risks he or she wishes to hedge and the hedging period and pays the hedging premium by sending calculated by the system amount of DHT tokens to DeHedge.

Planned Expansion of Hedging Product Portfolio

DeHedge plans to increase the number of hedging products for the crypto economy and crypto investors. Future planned DeHedge products include:

• The launch of test analytical coverage of major ICOs and events affecting the dynamics and cost of crypto assets;

• Expansion of the product line for miners and buyers of mining equipment to provide them protection from fluctuations in the rates of cryptocurrencies;

• The launch of investor hedging on alternative blockchains;

• The launch of AI scoring;

• The launch of a derivative platform with full functionality for hedging positions (by a decision of the investment committee in case of the absence of a platform toolkit that would meet the needs of the platform users);

• Crypto investor portfolio hedging.

The team believes that the introduction of new products onto the DeHedge platform will increase demand for DHT Tokens, which in turn should positively affect the value of DHT Tokens.

Token Placement Strategy

10,000,000,000 (ten billion) DeHedge Tokens will be issued. At the same time, no more than 2,500,000,000 (two and a half billion) Tokens will be offered for placement during the ICO. The reason for offering only 25% of all available Tokens is that DeHedge does not exclude the possibility of conducting additional rounds of sales to increase the main reserve and expand the scale of its business.

The following distribution will apply to the placed 2,500,000,000 DHT Tokens:

80% — will act as an offer within the framework of the Pre-Sale and ICO;

15% — project team and cofounders;

2% — bounty program;

1% —marketing;

2% — advisor compensation

The amount raised during the ICO will be distributed as follows:

80% — hedging reserves;

12% — project development and team administration;

6% — marketing and promotion;

2% — legal and accounting services.

Mini Roadmap

The beta version of the token sale protection platform is already live with a couple of token sale projects already partnered with DeHedge including Superbloom and Shivom.

Before this quarter is over – the DeHedge team plans to launch the hedging platform for tokens on the secondary market, launch test analytical coverage of significant ICOs and events affecting the dynamics and cost of crypto assets, launch underwriting and consulting services.

Before 2018 is over – the DeHedge team plans for launch of research portal, launch of hedging product for risks of mining, publication in user accounts of the first pool of tools available for hedging with DHT tokens, launch hedging on alternative blockchains, begin development of AI for project scoring, mobile application launch, while 2019 will focus on the development of derivatives platform with full functionality for hedging positions, all of the details can also be seen in the DeHedge whitepaper.

At its core, DeHedge is a decentralized risk-hedging platform for ICO and cryptocurrency investors by providing smart contracts which can save money invested into ICOs as well as cryptocurrency fluctuations. The DeHedge platform is also now open and is welcoming high-quality projects, helping them find their investors. The creators of the DeHedge platform believe that in the future it will develop into a fully functional ecosystem that will be associated with the crypto community for reliability, expertise and unique products to protect crypto assets.

Meet the Founders

- Mikhail Chernov – Founder & CEO, Successful IT entrepreneur, the founder of multiple startups, experienced investor in equity and cryptomarkets.

- Bogdan Leonov – Co-Founder & CCO, Experienced banking professional responsible for relationship management with top-tier clients in a number of local commercial banks.

- Dmitry Ansimov – Co-Founder & COO: Ph.D., investment banking professional and a partner of Russian top investment bank Troika Dialog (acquired by Sberbank) with 12+ years track record in Global Markets & IB.

For those interested in hedging, projects looking to partner or for those looking to contribute to the ICO, there is much more information to be found on the DeHedge official website. While we have organized a run down to better familiarize yourself with this project, the whitepaper is also available with a fuller view of the proposed hedging ecosystem.