San Francisco-based Bitwise Asset Management today announced the launch of its cryptocurrency index fund, the Bitwise HOLD 10 Private Index Fund, as well as the conclusion of a successful $4 million seed round. The strong institutional backing came from many well-known investors with domain expertise in asset management, FinTech, and crypto including Khosla Ventures via Keith Rabois, General Catalyst via Hemant Taneja, Blockchain Capital, David Sacks, Naval Ravikant, Suna Said, Adam Ludwin, Adam Nash, Elad Gil, Avichal Garg, and others.

“As cryptocurrencies become more mainstream, a private index fund, like Bitwise, is an incredibly important step to simplifying the complexities of the space and making it more accessible,” said investor Keith Rabois. “The Bitwise founders have done an exceptional job bringing world-class crypto experts onto their team to create a long-lasting financial institution.”

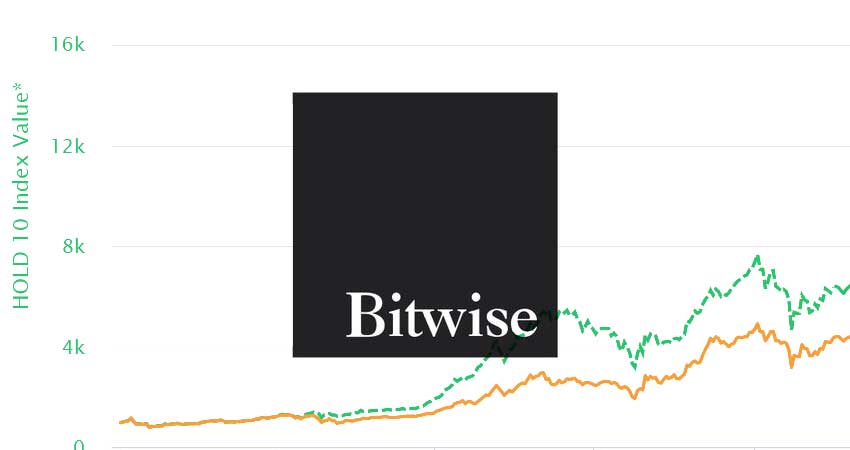

The Bitwise HOLD 10 Private Index Fund holds the top-10 most valuable crypto-assets, selected and weighted by market capitalization. The fund rebalances monthly, capitalizes on hard forks and airdrops, and is a low-cost way to gain exposure to the emerging crypto asset class. November was a powerful demonstration of the value of indexing this asset class: While BTC was up 58%, other top 10 coins like Monero and Dash were up more than 100%. As a result, the HOLD 10 Index outperformed Bitcoin (up 64% vs. 58%) while exhibiting 37% lower volatility. Year-to-date, the HOLD 10 Index is up over 1800%.

“While interest has been growing significantly, crypto-assets are still in the early stages of adoption and development as an asset class. Access to the category is still difficult and limited,” said Bitwise CEO Hunter Horsley. “According to a recent survey by Harris Poll, on behalf of Blockchain Capital, less than 2% of individuals own BTC. However, interest is significant, with 19% of respondents indicating they’re likely to buy BTC in the next 5 years. Interest is even higher, at 32%, among millennials.”

Founded in 2017, Bitwise Asset Management is a partner to individuals, financial advisors, family offices, investment managers and institutions in navigating cryptocurrency. With the mission to make it easy for anyone to invest in cryptocurrency, Bitwise develops funds, indexes, insight, and other services. The team behind Bitwise has expertise in technology, security, and finance.