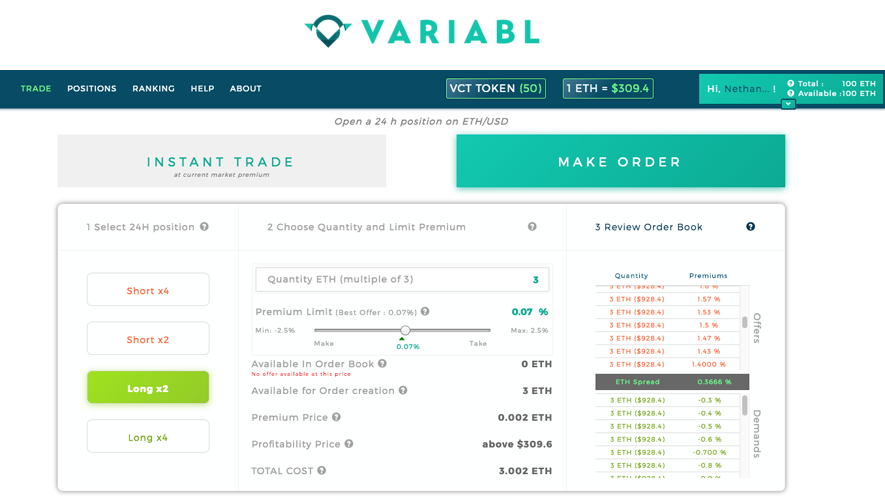

VariabL, a new application which leverages blockchain technology to offer a secure and efficient derivatives trading platform on Ethereum has announced the launch of its open alpha. The application allows with this release the demo trading of ETH/USD contracts.

VaribL uses trustless smart contracts to match traders, hold users funds and settle contracts. User funds are always securely stored on the blockchain.

The VariabL Open Alpha is a preliminary version of the company’s derivatives trading platform. As a “test” version running on the Kovan testnet, the VariabL Open Alpha is free and operates with worthless ether located in users’ personal accounts.

Zero-sum contracts

In VariabL’s ETH/USD derivatives market, users can create positions on the ETH/USD pair that behave as Contracts For price Difference (CFDs). These positions are implemented as Zero-sum ETH contracts on the blockchain.

By participating in the VariabL Open Alpha, users will be able to help the team test and improve the platform. Participants will have the opportunity to receive VariabL Contribution Tokens (VCT) as rewards for every participation or contribution.

Rebranding to VariabL

The company was first known as StabL but announced its rebranding to VariabL on September 5th. Regarding this decision the team stated:

VariabL, the first derivatives trading platform built on Ethereum, was initially introduced as a step needed to bring stable tokens to the ecosystem. After months of research and experimentation, we believe now that it can be much more than that.

Stability has always been at the center of our goal to ensure better and wider adoption of cryptocurrencies. We realized that stable tokens were only one of the assets required to enable financial stability for decentralized applications.

Stable tokens are one specific derivative product, but other derivative products are also essential to financial stability; when a business is systemically exposed to a risk (ie. the price of ether) they will often want to hedge this risk by taking an opposite exposure using derivatives (i.e. by shorting ETH). In other words, derivatives enable users to offset their exposure to any specific variable.

For these reasons we will focus our efforts on the VariabL derivatives platform that will issue our StabL Tokens.