Digital asset management platform ICONOMI has reported today its book value at the end of Q2 2017 reached $108,549,800.00, which represented an approximate increase of 402.4% from the first quarter of 2017. The crypto market environment was overall very favorable in the second quarter.

It should be noted that a large boost to ICONOMI’s assets also came from company spin-off Cofound.it’s token sale, where ICONOMI received 10% of total CFI token supply, corresponding to $8,621,000 at the end of the second quarter.

REVENUES

The revenues made in Q2 amount to $196,996. These revenues consist of:

· ICNX-Passive DAA entry/exit and management fee: $13,373

· ICNP-Managed DAA profit fee: $180,423

· ICN and CFI withdrawal fees: $3,200

Note that revenues presented are in USD equivalent, whereas structure consists of tokens such as BTC, ETH, ICNX, ICN, and CFI. ICNP sold 2398 units of GBYTE and received 3,059 ETH in Q2. Since GBYTE acquisition was free of charge, all sale proceeds represent realized profit and 20% of this profit is distributed to ICONOMI as a performance fee. ICNX, while still being in beta in Q2, collected $13,373 in fees, which includes a 3% annual management fee and an entry/exit fee of 0.1%. There are additional revenues of $3,200 in this period generated by platform withdrawals.

EXPENDITURES

Expenditures in Q2 2017 totaled $646,912. This includes salaries for 30 employees. In addition to this, ICONOMI has 4 external associates and other partners. There are also legal costs, marketing costs, rent, equipment and travel expenses.

REPAYMENT PROGRAM

In Q2 ICONOMI concluded its repayment program by buying and burning 99,305 ICN tokens using 1,000 ETH. The total amount of ICN tokens outstanding at the by the end of the second quarter stood at 99,900,695. In Q3, ICONOMI is continuing with its repayment program using revenues generated in Q2 which amounted to $196,996 or 668 ETH. This amount equals 20% of realized profit made by ICNP in Q2 and fees generated by the platform. The token burn smart contract can be viewed here.

WARNING: Do not send tokens to this address. Tokens sent to this address are permanently locked in the smart contract and cannot be recovered.

OTHER TRANSACTIONS

As mentioned before, ICONOMI received 10% of the Cofound.it token sale (50,000,000 CFI) as part of the compensation for project’s concept having been developed at ICONOMI.

![]()

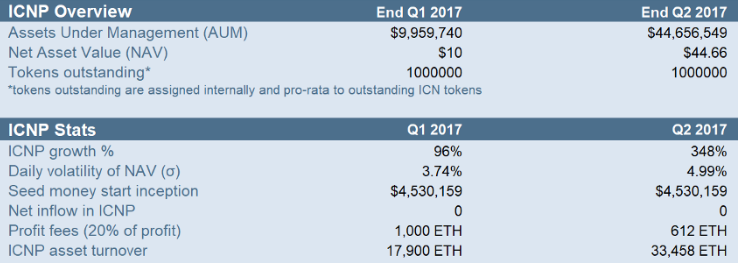

ICNP-Managed DAA

Since ICNP is a closed-end Digital Asset Array (DAA), all the growth in AUM is the result of asset growth included in the ICNP. At the end of Q2, the AUM measured $44,656,549. This corresponds to an increase of 314% since the beginning of the quarter. A large part of this growth was realized by the appreciation of the company’s uninvested assets such as Bitcoin and Ethereum.

ICNP participated in seven token sales within Q2 and in total invested 28,144 ETH and 90 BTC. These include Bancor, Aragon, Aeternity, iExec RLC, Cosmos, and Matchpool. The ICONOMI team says they are monitoring new and old investments very carefully. The company also closed approximately one-third of its Byteball position, leading to a realized profit of 3,059 ETH.

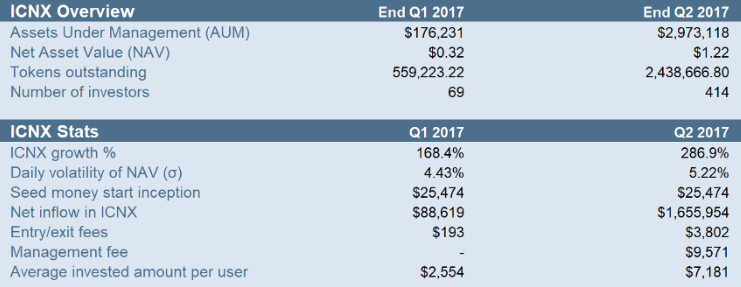

ICNX-Passive DAA

ICNX is a passively managed DAA with pre-defined rules published on the ICONOMI blog. Assets under management within ICNX at the end of Q2 2017 amounted to $2,973,118 and had 2,438,666.8 tokens outstanding, each worth $1.22 at the end of Q2. This is an increase of 287% since the beginning of the quarter. In Q2 2017, ICONOMI added 8 new tokens to ICNX, which now holds 21 different tokens.

For live information about specific assets included in ICNX, see the ICONOMI dashboard.

At the end of the quarter, ICNX tokens were held by 414 active investors, who on average have $7,181 of their assets invested. Total net money inflow measured $1,655,954 and was performed by 1,546 buy and 424 sell orders. There are an additional $1,360,000 of assets which are held in BTC and ETH and are not invested by platform users.