TradeBlock, the New York-headquartered digital currency data provider yesterday started to include trade data from crypto exchange Kraken and removed Bitfinex from its XBX index. Noted have been Bitfinex issues with price divergences ever since the exchange started having issues with client withdrawals citing issues with their Taiwan-based partner banks.

XBX Index deweights in real-time

The Bitfinex XBT/USD price has seen a notable increase since its users began experiencing delays and issues with USD withdrawals.

It can be theorized that Bitfinex customers are increasingly buying bitcoin at the exchange in order to move their funds to other venues or to their wallets. The theory would explain the XBT/USD price premium over the rest of the markets observed at Bitfinex during the days following the USD withdrawal freeze (currently at 7% over the XBX index reference rate).

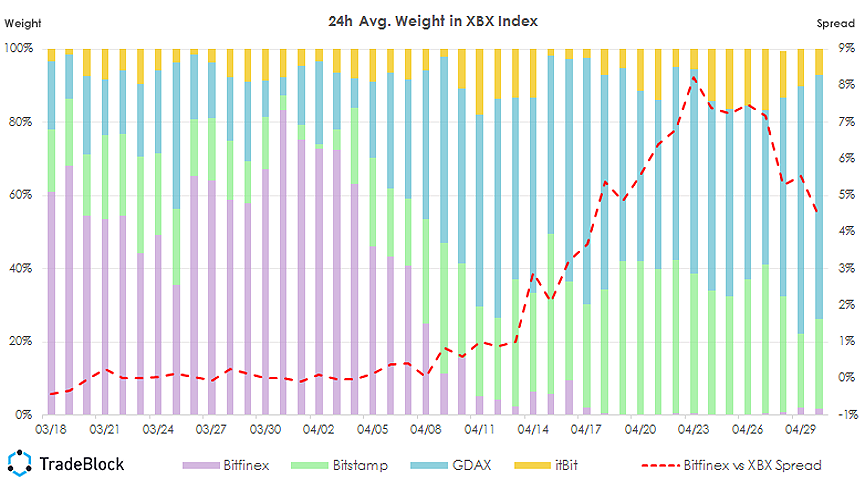

Notably, the price discrepancy at Bitfinex has been taken into account by the algorithm underlying the XBX index and the exchange’s weight in the index has been automatically and considerably discounted. By design, this has mitigated the influence of Bitfinex problems in the USD reference rate for the price of bitcoin provided by the XBX index. The chart below highlights the automated reduction in the 24h average weighting of Bitfinex’s price in the index, and the price divergence between Bitfinex and the rate calculated by the XBX index.

It is important to point out that Bitfinex’s price was discounted by the XBX Index despite the fact that their XBT/USD trading volume has continued to represent the highest share of the market. Events such as this continue to highlight the importance of an index that is designed to respond effectively to a wide range of market anomalies in real-time.

Enter San Francisco-headquartered Kraken

TradeBlock has decided to include Kraken’s XBT/EUR cross in the XBX index calculation. The inclusion of the Kraken exchange will increase the index’s exposure to the global price of bitcoin by including market activity from a traditionally well-regulated region, run by a company headquartered in the United States.

Kraken has been the world’s leading exchange by the measure of XBT/EUR trading volume. Trading volumes at the venue have been historically stable with a sustained positive growth trend.

The charts below display the trading volume activity over the past 6 months at Kraken and how its USD converted XBT/EUR price has traded close to the rest of the XBX constituents:

Kraken (XBT/EUR) has been a constituent of the XBX index in the past. The exchange formed part of the XBX index until May of 2015 when it was removed because the XBT/USD trading volume of exchanges around the world started picking up. Its re-inclusion is a direct response to the uncertain and shifting landscape of regulations and liquidity.

The team added:

“As unbiased observers of the bitcoin market, TradeBlock strives to provide a representative reference rate for the price of bitcoin. TradeBlock will continue to study and consider all markets participants that have significant trading volume, visible and sensible compliance practices, industry-standard trading mechanisms, publicly-known ownership and that impose no restrictions on their investors.”

For further information about the TradeBlock XBX index click here.