Blockchain Capital, a San Francisco-based venture capital firm investing in blockchain technology companies, officially announced today that it intends, subject to market and other conditions, to offer up to USD $10 million in digital tokens (BCAP tokens).

The announcement to raise money for the company’s third blockchain technology fund through an ICO was announced last month

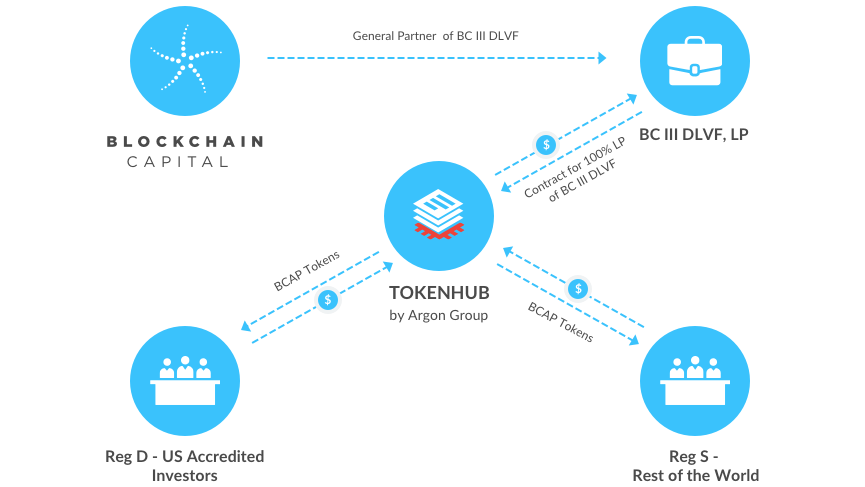

The BCAP tokens are an Ethereum-based smart contract digital token representing an indirect fractional non-voting economic interest in the firm’s Blockchain Capital III, Digital Liquid Venture Fund, LP (BC III DLVF).

The BCAP Tokens are expected to be issued by Blockchain Capital TokenHub Pte. Ltd., an indirect wholly-owned subsidiary of Argon Group Holdings (BC TokenHub). Full details on the tokens and the offering are disclosed in the Offering Memorandum.

BC TokenHub intends that the net proceeds of the offering will be transferred to BC III DLVF, which will, in exchange, grant BC III DLVF’s sole limited partnership interest to BC TokenHub.

BC III DLVF intends to use such proceeds to invest in blockchain technology, cryptocurrency businesses, and ICOs.

The BCAP tokens are being offered on a limited basis to a maximum of 99 accredited US investors under exemptions from registration with the U.S. Securities and Exchange Commission pursuant to Regulation D, Section 506(c) and Regulation S of the Securities and Exchange Act of 1933.

Only accredited investors within the US and non-US persons outside of the US will be eligible to purchase BCAP tokens.

Digital Liquid Venture Fund Terms

| Digital Liquid Venture Fund | |

| Investment Strategy | We leverage our unparalleled network to identify compelling investment opportunities that harness blockchain technologies |

| Exposure | Diverse exposure to the blockchain technology industry

Access to follow-on opportunities from Fund I and II in addition to new investment opportunities |

| Position Allocation | 50% New fund investments

50% Reserves for pro-rata and follow-on opportunities |

| Investment Quantity | 10-20 ($500k per deal) |

Digital Token Offering Terms

| Digital Token Offering Terms | |

| Token Denomination | 1 BCAP token = 1 USD |

| Token Cap | 10m BCAP tokens |

| Management Fees | 2.5% management fee, 25% performance fee |

| Token Buyback | If token price is less than the fund’s NAV, General Partner may purchase tokens in the market |

| Trading Term | Evergreen: traded in perpetuity once issued |

| Structure | Regulation D to US onshore investors, Regulation S to offshore investors |

| Expenses | Fund set-up; ongoing legal, accounting and administration costs |