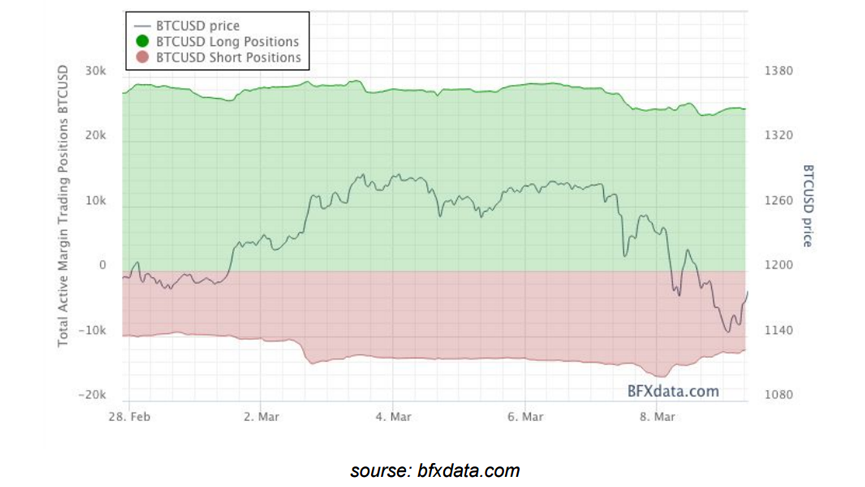

It is undeniable that there will be a large move in the market with the SEC bitcoin ETF approval decision, but which direction the price will go is too risky to assume. Therefore the optimal strategy to go with is hedging. It will allow you to place long and short positions, making sure you close the wrong position ASAP and let the correct one run further.

Key events of the period

Antpool mined a couple of Bitcoin Unlimited blocks, which dropped the price overnight. The fact that Antpool moved to Bitcoin Unlimited, could provoke other miners to sell out of their bitcoins to minimize the risks.

Waiting for the upcoming SEC decision about COIN ETF (the ruling is due as soon as today, Monday at the latest) creates a certain intensity in market sentiment. Experts had previously estimated the chance of the positive ruling as 25%. However, in the lead up to the ruling, traders are split with most recent bitcoin option derivatives from BitMEX showing traders betting up the SEC outcome of a greater than 50% chance for approval.

China

Chinese exchanges announced that they would not resume bitcoin withdrawals just yet. The possibility of unfreezing the withdrawals will appear after the end of the upcoming political event “Lianghui” that takes place in China on March 9-16. If the outcome is positive and exchanges get back in the game, that would mean increased trading volume, which can lead to either drop or rise in bitcoin price.

Summary

This week the market could be described as “awaiting” or “uncertain.” The bitcoin price went down after news about Antpool and now it is awaiting the imminent SEC decision. We hope for a positive ruling by the SEC, but let’s be rational and make sure we minimize our risks by hedging until the situation clears up.

This digest was prepared by allcointraders.com, a platform for manual and automated trading in cryptocurrency. If you have any comments or suggestions, please feel free to share it.

Disclaimer: The information of this article should not be regarded as investment/trading advice. Trading remains at your own risk. We are not granting any outcome from following our recommendations.