Derbit, the Lithuanian based bitcoin futures, and options exchange today notified of adjustments to their margin requirements in anticipation of heavy volatility around the Winklevoss ETF (COIN) approval decision.

The U.S. Securities and Exchange Commission (SEC) will vote on approval of a rule change that would allow for Bitcoin ETF listings to trade in the U.S. this upcoming weekend or Monday at the latest.

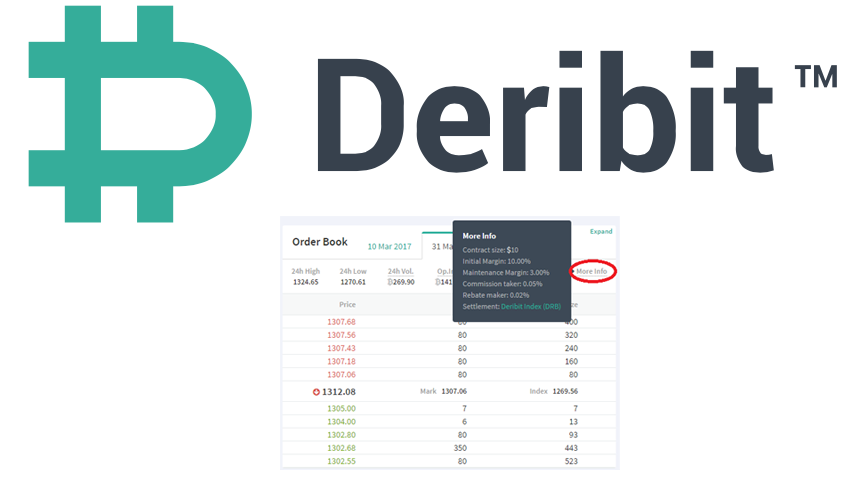

As a derivatives exchange Deribit allows for trade with leveraged positions and stated they must take precautions and will be temporary increasing Initial margin to 15% and maintenance margin will be set to 7.5% tomorrow (9th of March 2017).

Deribit will assure that no positions will go into direct liquidation due to increased Maintenance Margin, but informed traders to be aware of current positions.

Futures details:

– Initial margin: 15% (6.6x leverage)

– Maintenance margin: 7.5% (as of 9th of March)

– Taker fee: 0.05%

– Maker fee: -0.02%

Normally the exchange provides up to 20x leverage on futures and 10x leverage on options.

Note: These changes are only temporary and users will be informed of any other adjustments and notification of the return of leverage to normal.