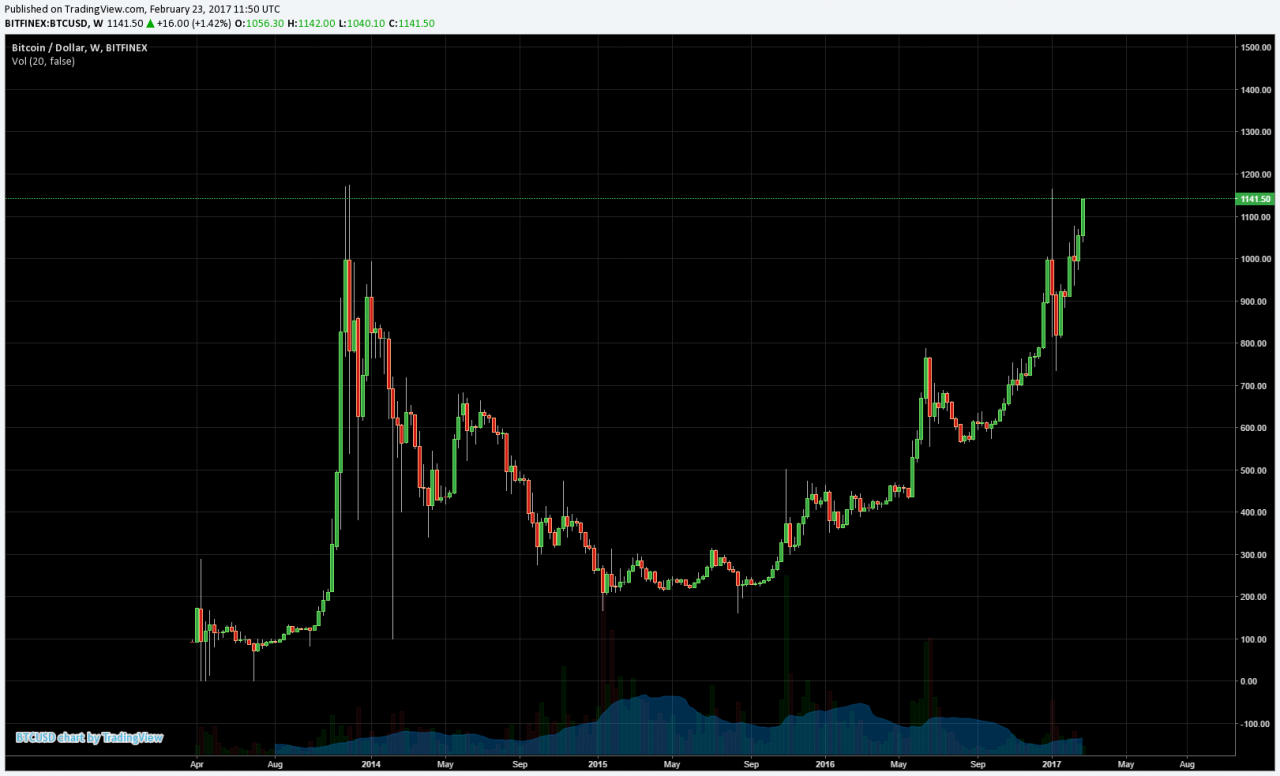

Depending on the exchange one watches, bitcoin may have already hit new all-time highs during this last week in February. Many exchanges have already reported new all-time highs in euro terms within the last 24 hours. CryptoNinjas uses Bitfinex data on our charts as reference points, thus views the all-time highs set back in 2013 at around $1,170 (chart above).

Heading into morning trade U.S. time on Thursday, February 23rd, it looks as if efforts by Chinese regulators during the last few weeks to probe the world’s biggest BTC exchanges are to ill-effect in tempering Chinese enthusiasm towards diversifying out of renminbi, should China continue to pursue a weak currency policy. Helsinki, Finland-based OTC bitcoin exchange service LocalBitcoins.com has reported new Chinese volume records in the wake of mainland Chinese exchanges halting withdrawals for up to a month.

To the contrary, advocates of cryptocurrency and bitcoin see the PBoC’s moves as validating their distrust of centralized monetary power and fiat paper. Crypto-bulls rallied behind the leading digital asset on any dips associated with Chinese regulation headline risk. Slowly but surely now, as forecasted last month in a CryptoNinjas technical price forecast, the BTC/USD price has slowly drifted back towards its all-time high range as we head into March.

Back in January 2017, the price action and momentum didn’t have enough steam to crack through 2013’s all-time highs. From Q4 2016’s sharp bull rally, due mostly to China, bitcoin then sold-off from the near all-time high double-top in the $1,150-$1,175 range to sail all the way back to $730 on January 9th.

However, just a month and a half later…that support level has stood firm as a deep supportive pin bar on the weekly candle formed and like a rocket bitcoin has shot back up to $1,140-50s (a sharp $400+ rise in price from January 9th to today February 22nd) and proved to be a great buying opportunity. Now, as we head into the end of Q1 with March approaching, BTC/USD looks ready to finally pass its 2013 all-time USD highs to test the $1,200 handle and then look for a new direction.

That next short-term direction will come next month as the Winklevoss Bitcoin ETF decision looms. Depending on the decision, price action could lead BTC back down towards psychological support at $1,000 on a non-approval or possibly make moves towards $1,300+ should ETFs based on cryptocurrency in the USA get approved for listing.

One thing is for sure, March is setting up for a little madness and volatility either way, for traders the volatility is welcomed. The question remains to be seen if long-term bitcoin bulls get another chance to buy any protracted dips or are higher highs going to be the norm for Q2? We believe $730-$1,000 remains a newly formed rock-solid support level if those levels should get tested again in a bearish scenario.

So what did derivative markets have to say about the bitcoin price? Check out the following tweet from bitcoin futures exchange Deribit.

31March17 #Options traded at 125% impl. volatility. Traders speculating on a #bitcoinprice higher than $1500 by the end of March. pic.twitter.com/fRSAzpbMDc

— Deribit (@DeribitExchange) February 23, 2017

UPDATE: 15 hours later from the time of publishing, EU-based exchange BitStamp recorded a new all-time high today at $1167.50, and mostly all exchanges reached new all-time highs across the board as bitcoin touched $1197/USD at Bitfinex on Thursday, February 23rd, 2017, before consolidating back under $1,200 as forecasted.