CryptoNinjas recently spoke with Shaun Gilchrist, the founder of BitcoinAverage.com for deeper insight into the services the site provides and his thoughts on recent developments in the cryptocurrency market.

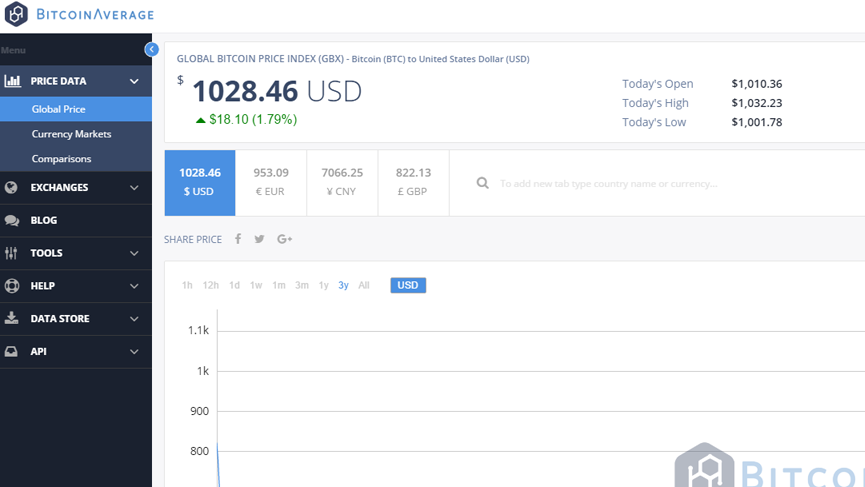

Starting initially with bitcoin to USD, EUR, GBP, CAD and PLN price pairs, BitcoinAverage has grown its dataset to now feature over 172 different fiat currencies.

They aggregate real-time bitcoin prices based on order books and transactions on over 48 major bitcoin exchanges around the world. This allowed them to provide long-established weighted average bitcoin price data to users in accounting, finance, bitcoin trading, bitcoin mining, as well as to bitcoin hobbyists. The service is available with a free limited allowance with a range of subscriptions for the API.

Since the pressure by regulators on popular exchanges to get rid of leverage on BTC/CNY trading and the introduction of fee-based trading you have announced the re-introduction of Chinese exchanges in your weighting index, explain your decision?

The debate regarding inflated volume in CNY order books has raged on for years. Being the world’s first bitcoin price index we’ve been heavily involved in the debate, and took the decision a long time ago to “ignore” such 0% fee exchanges.

When the announcements were made to return to a fee-based model our decision to remove such exchanges originally was vindicated, as there was a dramatic drop in volume across the board. We monitored the exchanges for a week before reintroducing them to the index.

So is it safe to assume USD is the true volume leader paired with BTC and not CNY?

From the initial few days, it is actually hard to say, we’ve seen CNY take the lead occasionally, the volume is very close to that of USD, far more so than we’ve seen from EUR. This will be an interesting metric to follow and chart in the coming weeks and months.

Is your trading and chart data all proprietary?

The BitcoinAverage project was initially open source and started development in late 2012. It has only been recently that we’ve closed the code, to take things in a direction that will enable us to provide a better service to existing and new clients.

What services are most popular with your API?

Of course, our Global Bitcoin Price Index (GBX) takes the lead here, price data is needed across the whole industry in many different fashions. The real-time ticker endpoints receive the most traffic, followed by our historical data sets.

Explain what you offer in your custom solutions, an example of building out something unique since your founding?

Our concept of a global index, generated by cross converting our local markets to a singular currency and then weighing them against each other was a world first.

We also provide the ability for users to generate a custom index based on a list of exchanges of their choosing, this is also unique and a first!

Right now you have data from Bitfinex, GDAX, and Bitstamp, any plans to add more exchange data?

We actually provide exchange data for every exchange in our system via API (around 60). We will add this data to the frontend in snapshot fashion soon, but the real-time aspect you refer to is limited to exchanges that provide WebSocket feeds with the required data.

Same with currencies, you provide data on BTC, LTC and ETH, will and can you offer other cryptocurrencies?

Without intending to offend, we have never felt that bitcoin will be superseded by another cryptocurrency, and so it has been our main focus. We have integrated LTC and ETH due to sheer demand from our users, and have not had any requests for other cryptocurrency data.

This isn’t to say that we can’t or will not add more in the future, though!

Many well-known companies including Xapo and BitGo and more, use your data, how active is BitcoinAverage in the B2B data space?

Yes, in fact, the majority of our clients are businesses, from wallets, exchanges and p2p brokers to bitcoin ATMs. Our premium plans provide access to our maintained APIs and we find this is what businesses prefer.

Do you have anything new coming in the pipeline for 2017 and beyond?

We are constantly improving and growing, for sure there will be new additions in 2017!